Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

النسخة 22الرقم المعياري الدولي: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

النسخة 22الرقم المعياري الدولي: 978-0077862275 تمرين 38

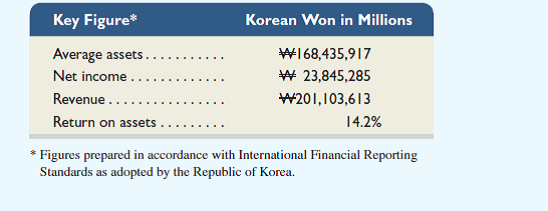

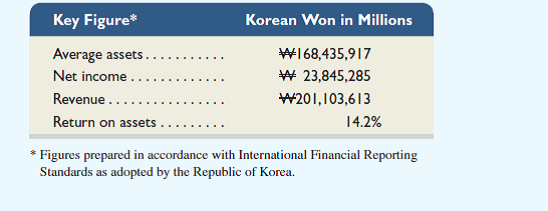

Samsung ( Samsung.com ) is a leading global manufacturer, and it competes to varying degrees with both Apple and Google. Key financial figures for Samsung follow.

Required

1. Identify any concerns you have in comparing Samsung's income and revenue figures to those of Apple and Google (in BTN 1-2) for purposes of making business decisions.

2. Identify any concerns you have in comparing Samsung's return on assets ratio to those of Apple and Google (computed for BTN 1-2) for purposes of making business decisions.

Reference: Problem BTN 1-2

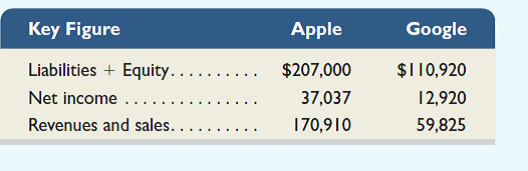

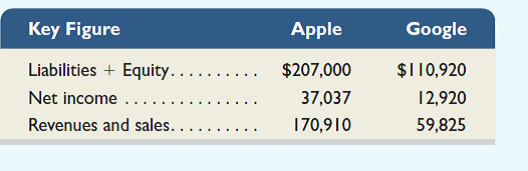

Key comparative figures ($ millions) for both Apple and Google follow.

Required

1. What is the total amount of assets invested in ( a ) Apple and ( b ) Google

2. What is the return on assets for ( a ) Apple and ( b ) Google Apple's beginning-year assets equal

$176,064 (in millions) and Google's beginning-year assets equal $93,798 (in millions).

3. How much are expenses for ( a ) Apple and ( b ) Google

4. Is return on assets satisfactory for ( a ) Apple and ( b ) Google (Assume competitors average a 10% return.)

5. What can you conclude about Apple and Google from these computations

Required

1. Identify any concerns you have in comparing Samsung's income and revenue figures to those of Apple and Google (in BTN 1-2) for purposes of making business decisions.

2. Identify any concerns you have in comparing Samsung's return on assets ratio to those of Apple and Google (computed for BTN 1-2) for purposes of making business decisions.

Reference: Problem BTN 1-2

Key comparative figures ($ millions) for both Apple and Google follow.

Required

1. What is the total amount of assets invested in ( a ) Apple and ( b ) Google

2. What is the return on assets for ( a ) Apple and ( b ) Google Apple's beginning-year assets equal

$176,064 (in millions) and Google's beginning-year assets equal $93,798 (in millions).

3. How much are expenses for ( a ) Apple and ( b ) Google

4. Is return on assets satisfactory for ( a ) Apple and ( b ) Google (Assume competitors average a 10% return.)

5. What can you conclude about Apple and Google from these computations

التوضيح

IFRS

IFRS involves set of the set perta...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255