Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

النسخة 22الرقم المعياري الدولي: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

النسخة 22الرقم المعياري الدولي: 978-0077862275 تمرين 41

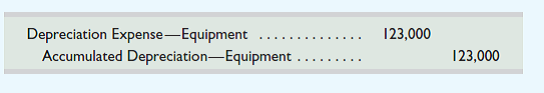

Jessica Boland works for Sea Biscuit Co. She and Farah Smith, her manager, are preparing adjusting entries for annual financial statements. Boland computes depreciation and records it as

Smith agrees with her computation but says the credit entry should be directly to the Equipment account.

Smith argues that while accumulated depreciation is technically correct, "it is less hassle not to use a contra account and just credit the Equipment account directly. And besides, the balance sheet shows the same amount for total assets under either method."

Required

1. How should depreciation be recorded Do you support Boland or Smith

2. Evaluate the strengths and weaknesses of Smith's reasons for preferring her method.

3. Indicate whether the situation Boland faces is an ethical problem. Explain.

Smith agrees with her computation but says the credit entry should be directly to the Equipment account.

Smith argues that while accumulated depreciation is technically correct, "it is less hassle not to use a contra account and just credit the Equipment account directly. And besides, the balance sheet shows the same amount for total assets under either method."

Required

1. How should depreciation be recorded Do you support Boland or Smith

2. Evaluate the strengths and weaknesses of Smith's reasons for preferring her method.

3. Indicate whether the situation Boland faces is an ethical problem. Explain.

التوضيح

1. GAAP requires that annual deprecation...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255