Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

النسخة 22الرقم المعياري الدولي: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

النسخة 22الرقم المعياري الدولي: 978-0077862275 تمرين 49

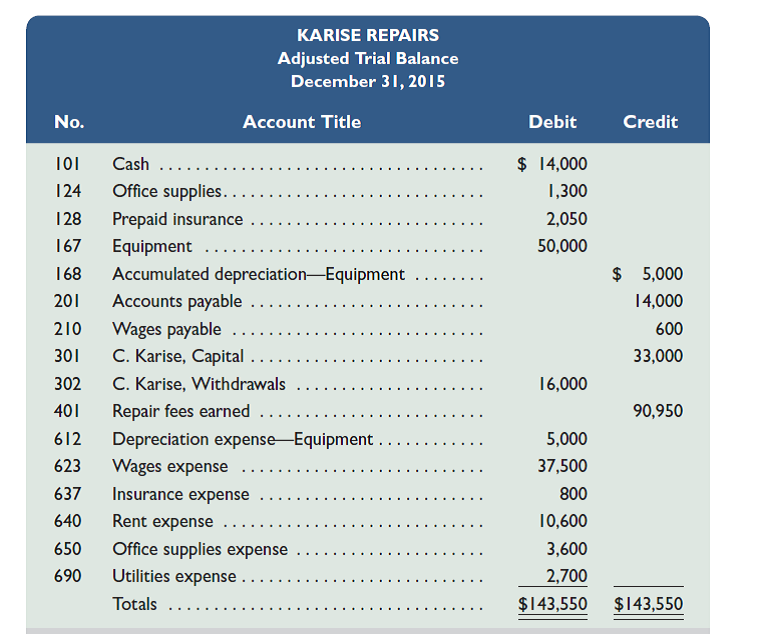

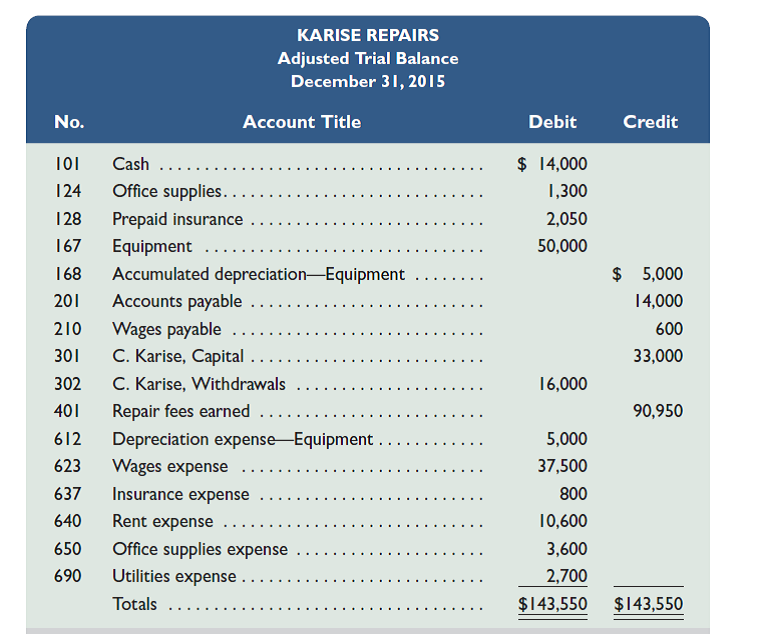

The adjusted trial balance of Karise Repairs on December 31, 2015, follows.

Required

1. Prepare an income statement and a statement of owner's equity for the year 2015, and a classified balance sheet at December 31, 2015. There are no owner investments in 2015.

2. Enter the adjusted trial balance in the first two columns of a six-column table. Use columns three and four for closing entry information and the last two columns for a post-closing trial balance. Insert an Income Summary account as the last item in the trial balance.

3. Enter closing entry information in the six-column table and prepare journal entries for it.

Analysis Component

4. Assume for this part only that

a. None of the $800 insurance expense had expired during the year. Instead, assume it is a prepayment of the next period's insurance protection.

b. There are no earned and unpaid wages at the end of the year. ( Hint: Reverse the $600 wages payable accrual.)

Describe the financial statement changes that would result from these two assumptions.

Required

1. Prepare an income statement and a statement of owner's equity for the year 2015, and a classified balance sheet at December 31, 2015. There are no owner investments in 2015.

2. Enter the adjusted trial balance in the first two columns of a six-column table. Use columns three and four for closing entry information and the last two columns for a post-closing trial balance. Insert an Income Summary account as the last item in the trial balance.

3. Enter closing entry information in the six-column table and prepare journal entries for it.

Analysis Component

4. Assume for this part only that

a. None of the $800 insurance expense had expired during the year. Instead, assume it is a prepayment of the next period's insurance protection.

b. There are no earned and unpaid wages at the end of the year. ( Hint: Reverse the $600 wages payable accrual.)

Describe the financial statement changes that would result from these two assumptions.

التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255