Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

النسخة 22الرقم المعياري الدولي: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

النسخة 22الرقم المعياري الدولي: 978-0077862275 تمرين 50

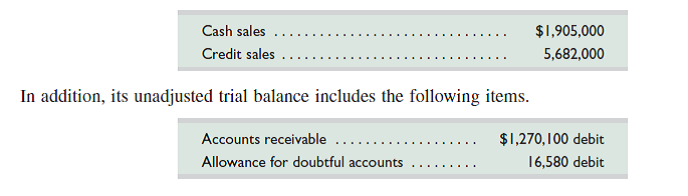

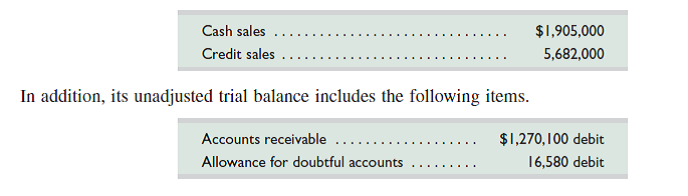

At December 31, 2015, Hawke Company reports the following results for its calendar year.

Required

1. Prepare the adjusting entry for this company to recognize bad debts under each of the following independent assumptions.

a. Bad debts are estimated to be 1.5% of credit sales.

b. Bad debts are estimated to be 1% of total sales.

c. An aging analysis estimates that 5% of year-end accounts receivable are uncollectible.

2. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31, 2015, balance sheet given the facts in part 1 a.

3. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31, 2015, balance sheet given the facts in part 1 c.

Required

1. Prepare the adjusting entry for this company to recognize bad debts under each of the following independent assumptions.

a. Bad debts are estimated to be 1.5% of credit sales.

b. Bad debts are estimated to be 1% of total sales.

c. An aging analysis estimates that 5% of year-end accounts receivable are uncollectible.

2. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31, 2015, balance sheet given the facts in part 1 a.

3. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31, 2015, balance sheet given the facts in part 1 c.

التوضيح

Journal entry

In accounting journal ent...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255