Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

النسخة 22الرقم المعياري الدولي: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

النسخة 22الرقم المعياري الدولي: 978-0077862275 تمرين 15

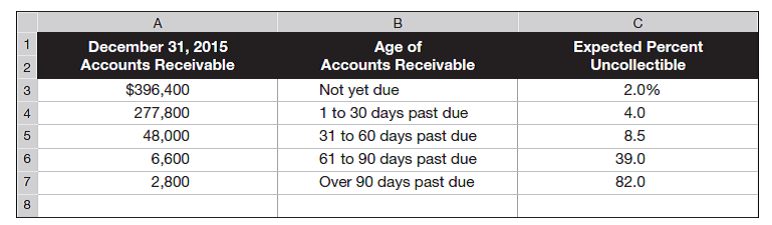

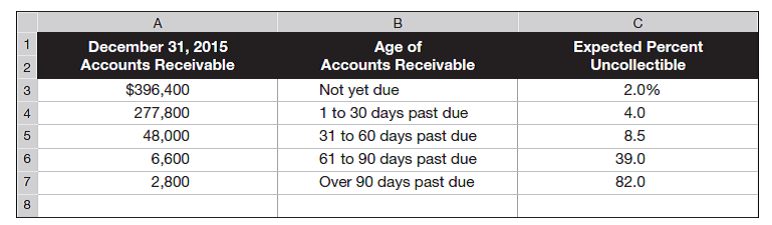

Hovak Company has credit sales of $4.5 million for year 2015. At December 31, 2015, the company's Allowance for Doubtful Accounts has an unadjusted debit balance of $3,400. Hovak prepares a schedule of its December 31, 2015, accounts receivable by age. On the basis of past experience, it estimates the percent of receivables in each age category that will become uncollectible. This information is summarized here.

Required

1. Compute the required balance of the Allowance for Doubtful Accounts at December 31, 2015, using the aging of accounts receivable method.

2. Prepare the adjusting entry to record bad debts expense at December 31, 2015.

Analysis Component

3. On July 31, 2016, Hovak concludes that a customer's $3,455 receivable (created in 2015) is uncollectible and that the account should be written off. What effect will this action have on Hovak's 2016 net income Explain.

Required

1. Compute the required balance of the Allowance for Doubtful Accounts at December 31, 2015, using the aging of accounts receivable method.

2. Prepare the adjusting entry to record bad debts expense at December 31, 2015.

Analysis Component

3. On July 31, 2016, Hovak concludes that a customer's $3,455 receivable (created in 2015) is uncollectible and that the account should be written off. What effect will this action have on Hovak's 2016 net income Explain.

التوضيح

Estimate bad debt expenses using aging o...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255