Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

النسخة 22الرقم المعياري الدولي: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

النسخة 22الرقم المعياري الدولي: 978-0077862275 تمرين 20

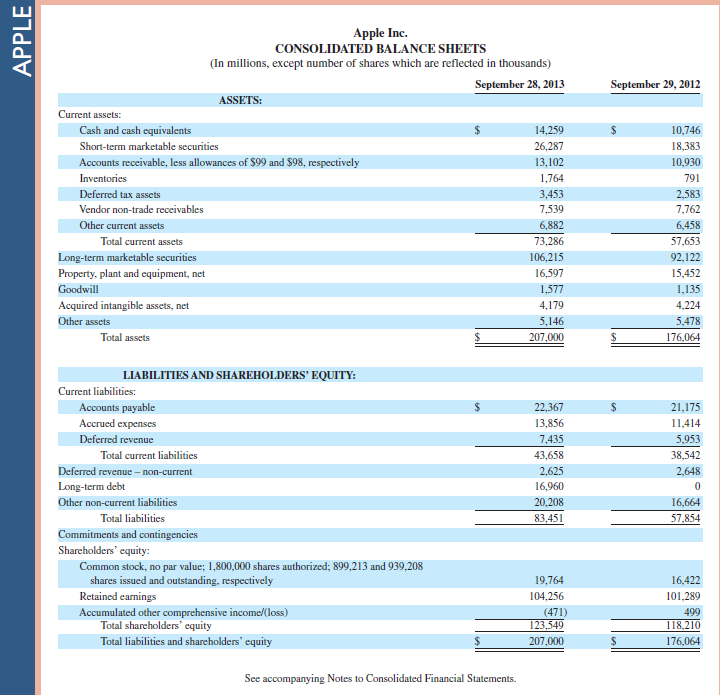

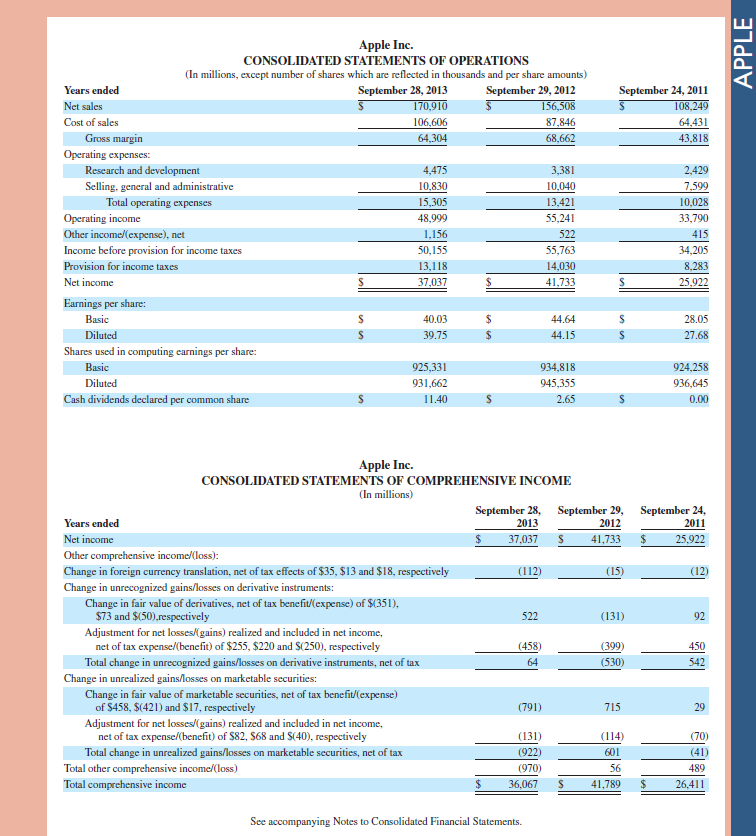

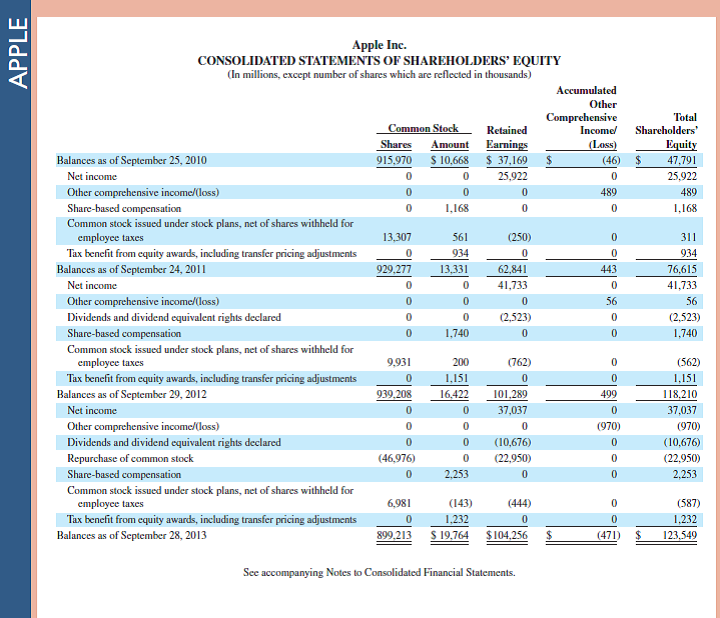

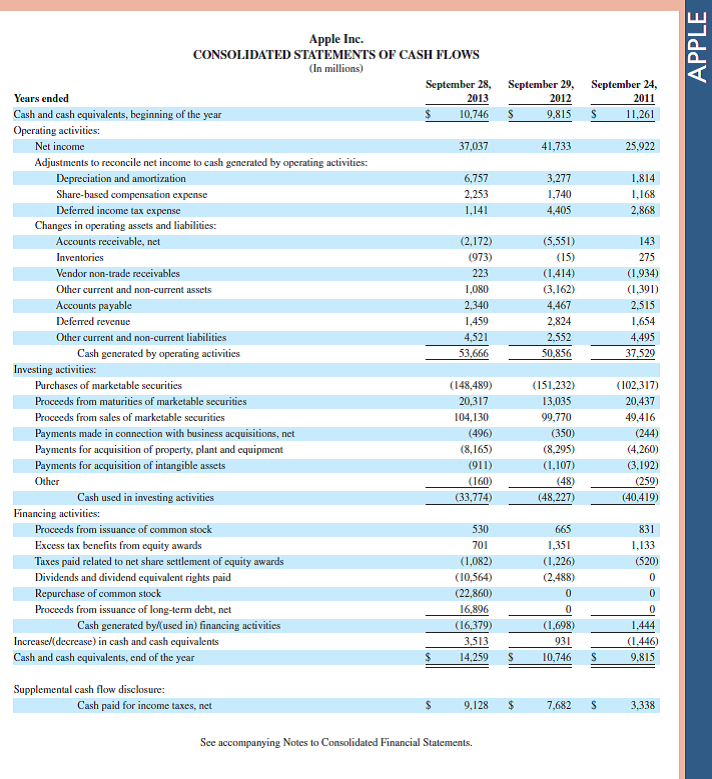

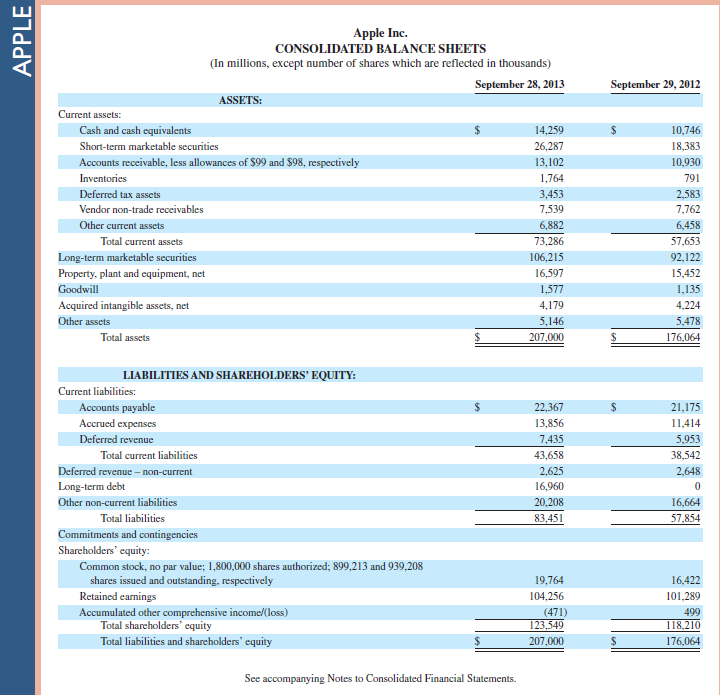

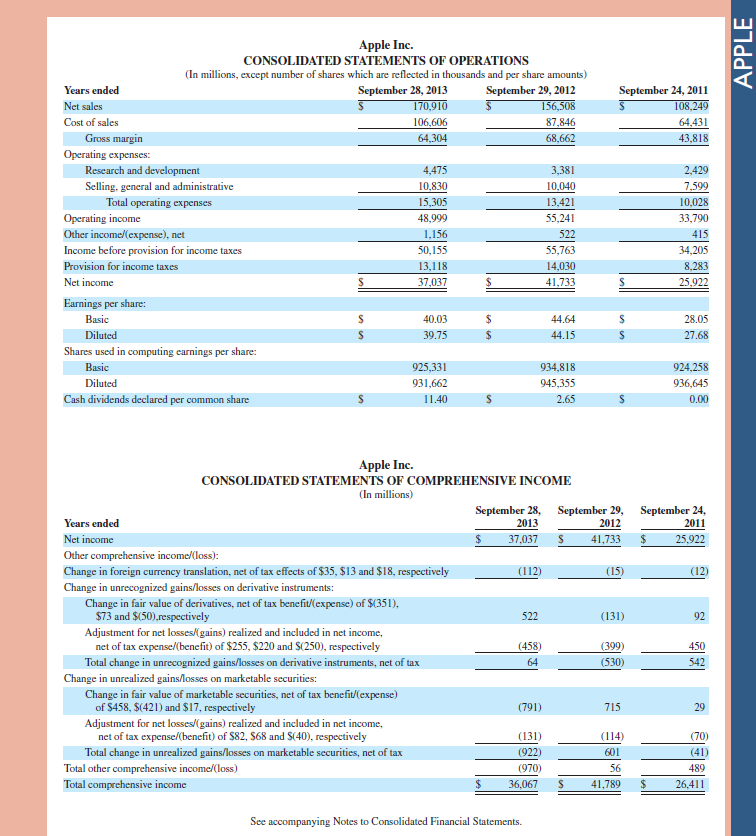

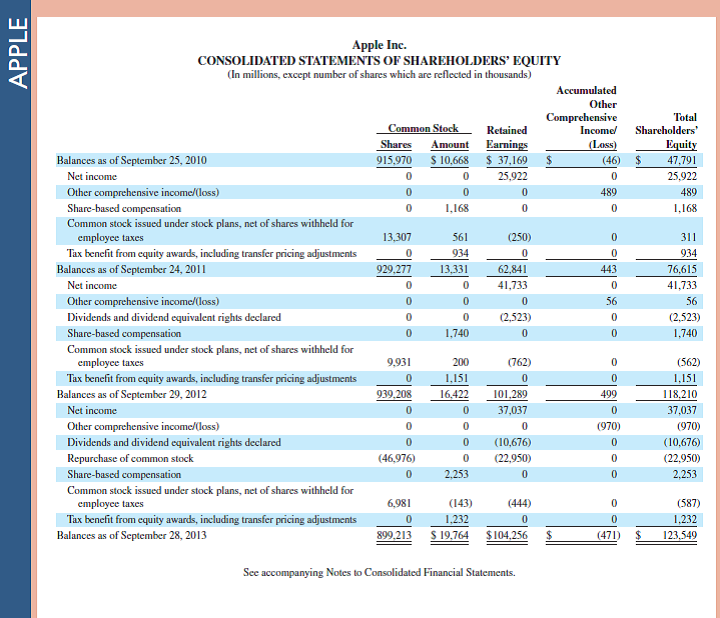

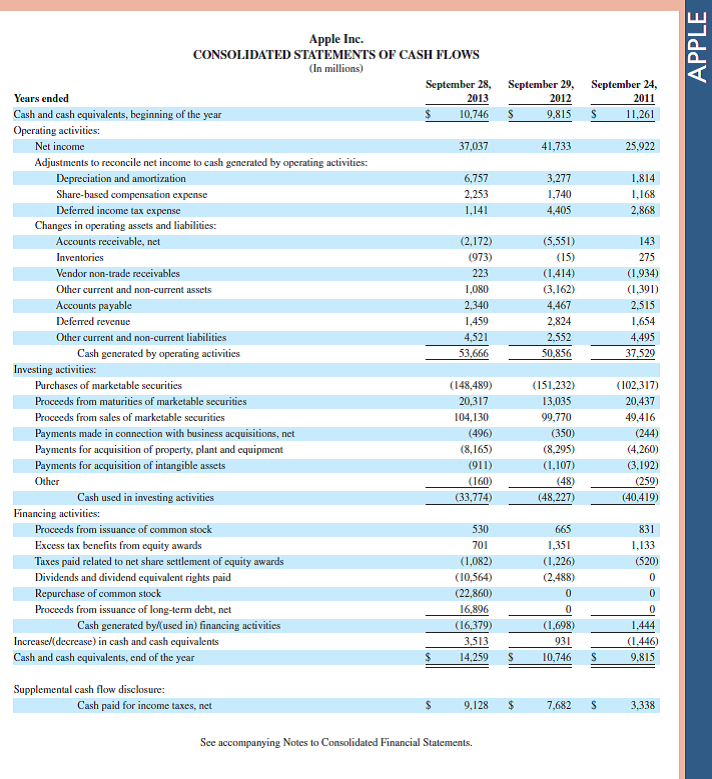

Refer to Apple 's financial statements in Appendix A to answer the following.

1. Using fiscal 2011 as the base year, compute trend percents for fiscal years 2011, 2012, and 2013 for net sales, cost of sales, operating income, other income (expense) net, provision for income taxes, and net income. (Round percents to one decimal.)

2. Compute common-size percents for fiscal years 2012 and 2013 for the following categories of assets: ( a ) total current assets, ( b ) property, plant and equipment, net, and ( c ) goodwill plus acquired intangible assets, net. (Round percents to one decimal.)

3. Comment on any notable changes across the years for the income statement trends computed in part 1 and the balance sheet percents computed in part 2.

Fast Forward

4. Access Apple's financial statements for fiscal years ending after September 28, 2013, from its website ( Apple.com ) or the SEC database ( www.SEC.gov ). Update your work for parts 1, 2, and 3 using the new information accessed.

Reference : Apple 's financial statements in Appendix A

1. Using fiscal 2011 as the base year, compute trend percents for fiscal years 2011, 2012, and 2013 for net sales, cost of sales, operating income, other income (expense) net, provision for income taxes, and net income. (Round percents to one decimal.)

2. Compute common-size percents for fiscal years 2012 and 2013 for the following categories of assets: ( a ) total current assets, ( b ) property, plant and equipment, net, and ( c ) goodwill plus acquired intangible assets, net. (Round percents to one decimal.)

3. Comment on any notable changes across the years for the income statement trends computed in part 1 and the balance sheet percents computed in part 2.

Fast Forward

4. Access Apple's financial statements for fiscal years ending after September 28, 2013, from its website ( Apple.com ) or the SEC database ( www.SEC.gov ). Update your work for parts 1, 2, and 3 using the new information accessed.

Reference : Apple 's financial statements in Appendix A

التوضيح

Trend analysis assesses business financi...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255