Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

النسخة 22الرقم المعياري الدولي: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

النسخة 22الرقم المعياري الدولي: 978-0077862275 تمرين 30

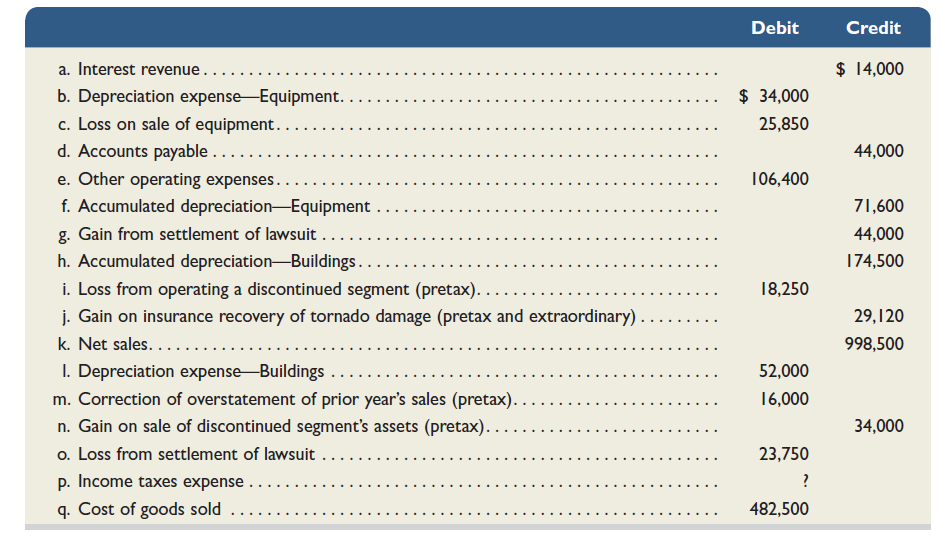

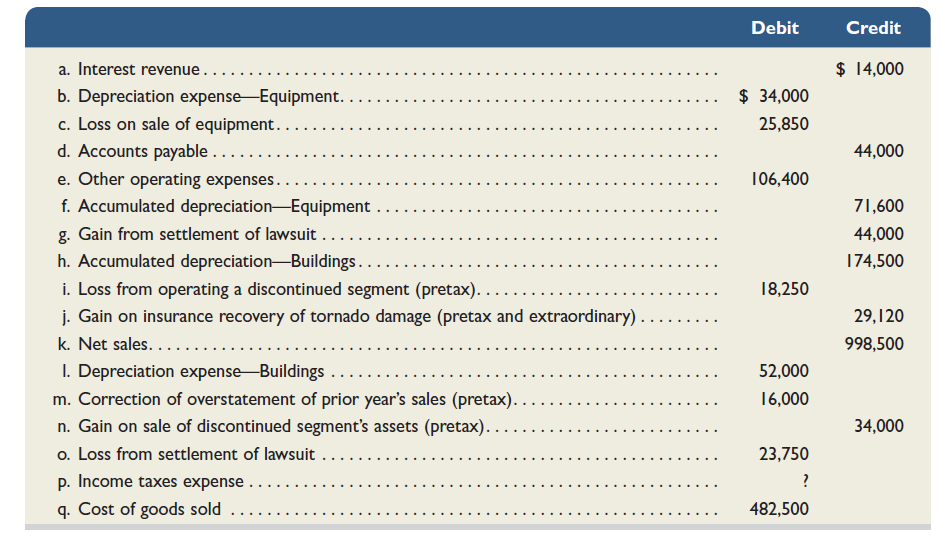

Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar yearend December 31, 2015, follow.

Required

Answer each of the following questions by providing supporting computations.

1. Assume that the company's income tax rate is 30% for all items. Identify the tax effects and after-tax amounts of the four items labeled pretax.

2. What is the amount of income from continuing operations before income taxes What is the amount of the income taxes expense What is the amount of income from continuing operations

3. What is the total amount of after-tax income (loss) associated with the discontinued segment

4. What is the amount of income (loss) before the extraordinary items

5. What is the amount of net income for the year

Required

Answer each of the following questions by providing supporting computations.

1. Assume that the company's income tax rate is 30% for all items. Identify the tax effects and after-tax amounts of the four items labeled pretax.

2. What is the amount of income from continuing operations before income taxes What is the amount of the income taxes expense What is the amount of income from continuing operations

3. What is the total amount of after-tax income (loss) associated with the discontinued segment

4. What is the amount of income (loss) before the extraordinary items

5. What is the amount of net income for the year

التوضيح

When a firm's revenue and expenses trans...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255