Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

النسخة 22الرقم المعياري الدولي: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

النسخة 22الرقم المعياري الدولي: 978-0077862275 تمرين 18

Hip-Hop Co. manufactures and markets several products. Management is considering the future of one product, electronic keyboards, that has not been as profitable as planned. Since this product is manufactured and marketed independently of the other products, its total costs can be precisely measured. Next year's plans call for a $350 selling price per unit. The fixed costs for the year are expected to be $42,000, up to a maximum capacity of 700 units. Forecasted variable costs are $210 per unit.

Required

1. Estimate the keyboards' break-even point in terms of (a) sales units and (b) sales dollars.

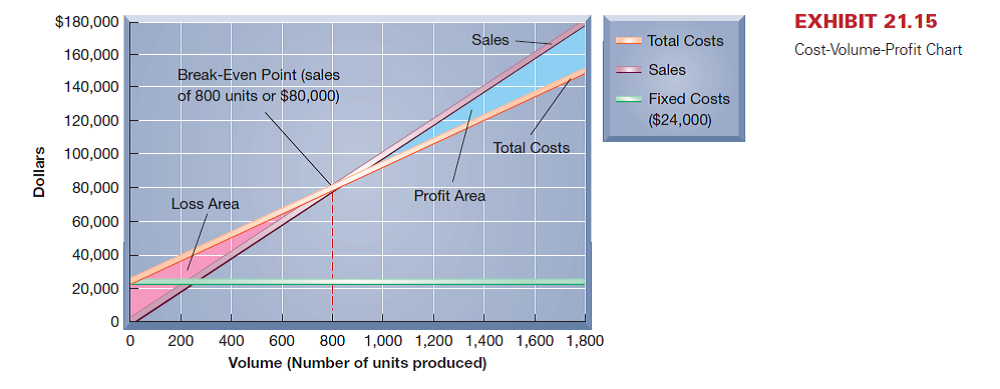

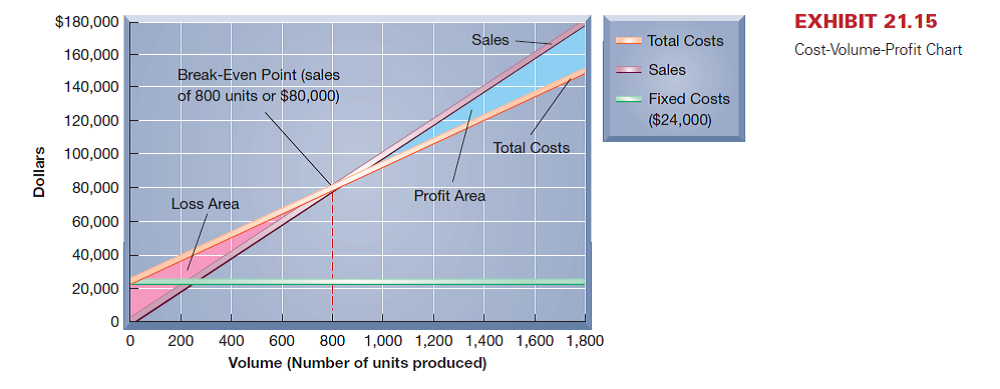

2. Prepare a CVP chart for keyboards like that in Exhibit 21.15. Use 700 keyboards as the maximum number of sales units on the horizontal axis of the graph, and $250,000 as the maximum dollar amount on the vertical axis.

3. Prepare a contribution margin income statement showing sales, variable costs, and fixed costs for keyboards at the break-even point.

Reference: Exhibit 21.15.

Required

1. Estimate the keyboards' break-even point in terms of (a) sales units and (b) sales dollars.

2. Prepare a CVP chart for keyboards like that in Exhibit 21.15. Use 700 keyboards as the maximum number of sales units on the horizontal axis of the graph, and $250,000 as the maximum dollar amount on the vertical axis.

3. Prepare a contribution margin income statement showing sales, variable costs, and fixed costs for keyboards at the break-even point.

Reference: Exhibit 21.15.

التوضيح

1)

a)

Calculate break-even point in un...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255