Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

النسخة 22الرقم المعياري الدولي: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

النسخة 22الرقم المعياري الدولي: 978-0077862275 تمرين 52

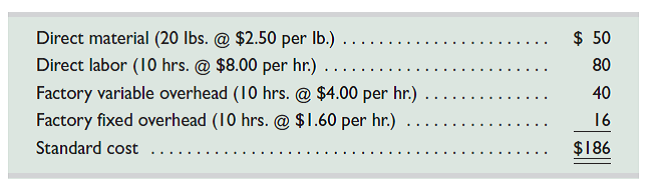

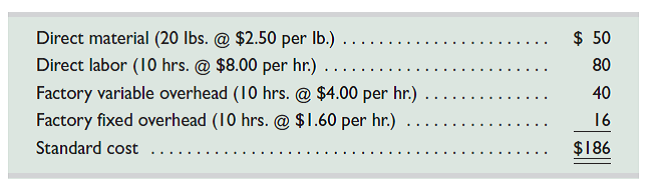

Sedona Company set the following standard costs for one unit of its product for 2015.

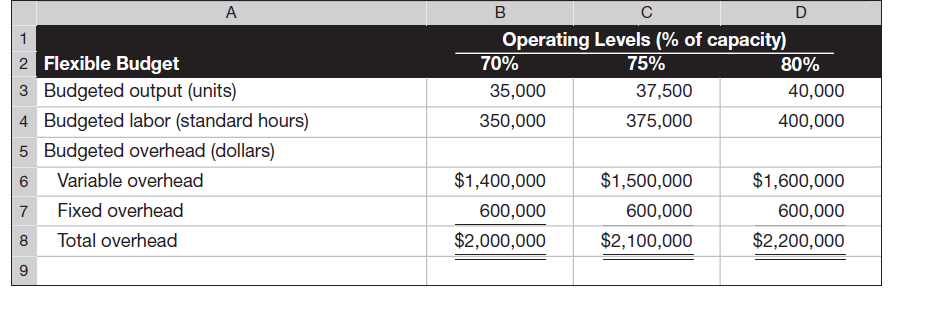

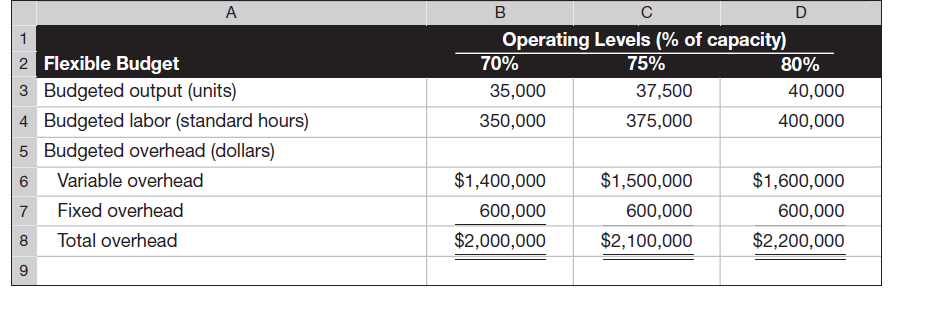

The $5.60 ($4.00 1 $1.60) total overhead rate per direct labor hour is based on an expected operating level equal to 75% of the factory's capacity of 50,000 units per month. The following monthly flexible budget information is also available.

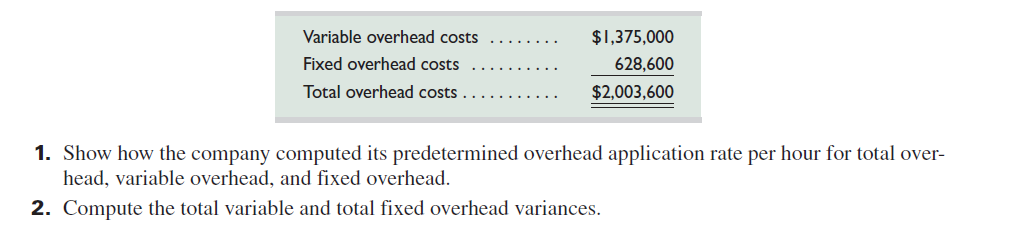

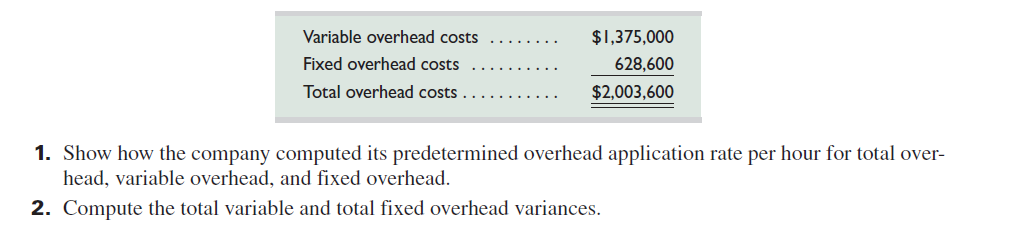

During the current month, the company operated at 70% of capacity, employees worked 340,000 hours, and the following actual overhead costs were incurred.

The $5.60 ($4.00 1 $1.60) total overhead rate per direct labor hour is based on an expected operating level equal to 75% of the factory's capacity of 50,000 units per month. The following monthly flexible budget information is also available.

During the current month, the company operated at 70% of capacity, employees worked 340,000 hours, and the following actual overhead costs were incurred.

التوضيح

Overhead cost Variance

Overhead cost ar...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255