Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

النسخة 22الرقم المعياري الدولي: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

النسخة 22الرقم المعياري الدولي: 978-0077862275 تمرين 42

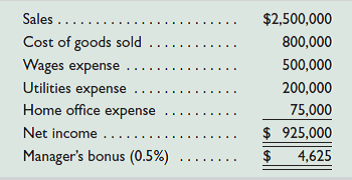

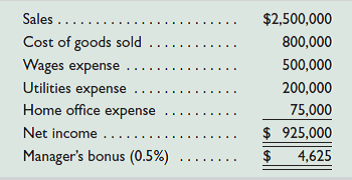

Improvement Station is a national home improvement chain with more than 100 stores throughout the country. The manager of each store receives a salary plus a bonus equal to a percent of the store's net income for the reporting period. The following net income calculation is on the Denver store manager's performance report for the recent monthly period.

In previous periods, the bonus had also been 0.5%, but the performance report had not included any charges for the home office expense, which is now assigned to each store as a percent of its sales.

Required

Assume that you are the national office manager. Write a half-page memorandum to your store managers explaining why home office expense is in the new performance report.

In previous periods, the bonus had also been 0.5%, but the performance report had not included any charges for the home office expense, which is now assigned to each store as a percent of its sales.

Required

Assume that you are the national office manager. Write a half-page memorandum to your store managers explaining why home office expense is in the new performance report.

التوضيح

Memorandum

To: Store Managers

From: Nat...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255