Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

النسخة 22الرقم المعياري الدولي: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

النسخة 22الرقم المعياري الدولي: 978-0077862275 تمرين 62

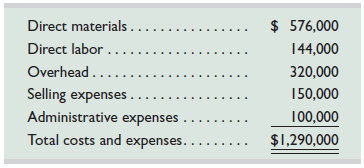

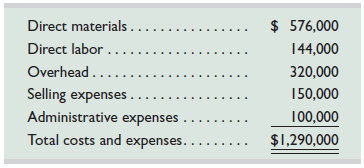

Jones Products manufactures and sells to wholesalers approximately 400,000 packages per year of underwater markers at $6 per package. Annual costs for the production and sale of this quantity are shown in the table.

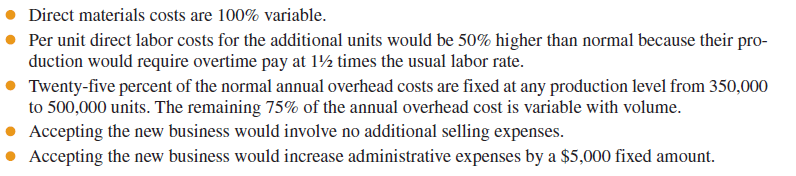

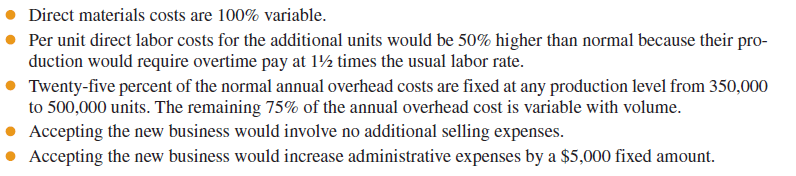

A new wholesaler has offered to buy 50,000 packages for $5.20 each. These markers would be marketed under the wholesaler's name and would not affect Jones Products's sales through its normal channels. A study of the costs of this additional business reveals the following:

Required

Prepare a three-column comparative income statement that shows the following:

1. Annual operating income without the special order (column 1).

2. Annual operating income received from the new business only (column 2).

3. Combined annual operating income from normal business and the new business (column 3).

A new wholesaler has offered to buy 50,000 packages for $5.20 each. These markers would be marketed under the wholesaler's name and would not affect Jones Products's sales through its normal channels. A study of the costs of this additional business reveals the following:

Required

Prepare a three-column comparative income statement that shows the following:

1. Annual operating income without the special order (column 1).

2. Annual operating income received from the new business only (column 2).

3. Combined annual operating income from normal business and the new business (column 3).

التوضيح

1.

The annual operating income without ...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255