Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910 تمرين 8

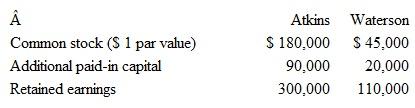

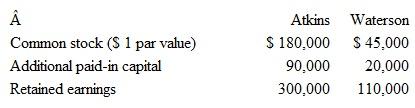

Prior to being united in a business combination.Atkins, Inc., and Waterson Corporation had the following stockholders' equity figures:  Atkins issues 51,000 new shares of its common stock valued at $3 per share for all of the outstanding stock of Waterson.Immediately afterward, what are consolidated Additional Paid- In Capital and Retained Earnings, respectively

Atkins issues 51,000 new shares of its common stock valued at $3 per share for all of the outstanding stock of Waterson.Immediately afterward, what are consolidated Additional Paid- In Capital and Retained Earnings, respectively

a.$104,000 and $300,000.

b.$110,000 and $410,000.

c.$192,000 and $300,000.

d.$212,000 and $410,000.

Atkins issues 51,000 new shares of its common stock valued at $3 per share for all of the outstanding stock of Waterson.Immediately afterward, what are consolidated Additional Paid- In Capital and Retained Earnings, respectively

Atkins issues 51,000 new shares of its common stock valued at $3 per share for all of the outstanding stock of Waterson.Immediately afterward, what are consolidated Additional Paid- In Capital and Retained Earnings, respectively a.$104,000 and $300,000.

b.$110,000 and $410,000.

c.$192,000 and $300,000.

d.$212,000 and $410,000.

التوضيح

Retained earnings:

Retained earnings ar...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255