Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910 تمرين 46

Problems 17 through 19 should be viewed as independent situations.They are based on the following data:

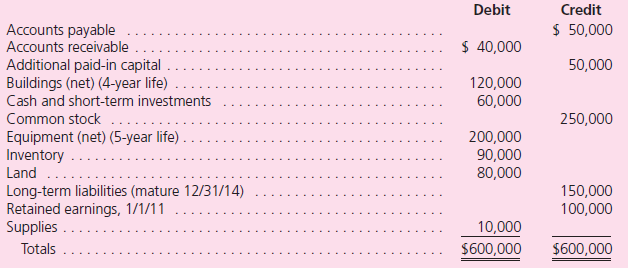

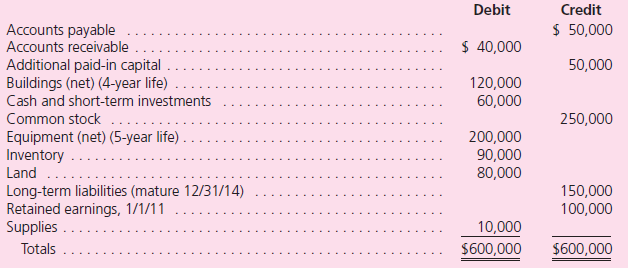

Chapman Company obtains 100 percent of Abernethy Company's stock on January 1, 2011.As of that date, Abernethy has the following trial balance:

During 2011, Abernethy reported income of $80,000 while paying dividends of $10,000.During 2012, Abernethy reported income of $110,000 while paying dividends of $30,000.

Assume that Chapman Company acquired Abernethy's common stock for $500,000 in cash.Assume that the equipment and long-term liabilities had fair values of $220,000 and $120,000, respectively, on the acquisition date.Chapman uses the initial value method to account for its investment.Prepare consolidation worksheet entries for December 31, 2011, and December 31, 2012.

Chapman Company obtains 100 percent of Abernethy Company's stock on January 1, 2011.As of that date, Abernethy has the following trial balance:

During 2011, Abernethy reported income of $80,000 while paying dividends of $10,000.During 2012, Abernethy reported income of $110,000 while paying dividends of $30,000.

Assume that Chapman Company acquired Abernethy's common stock for $500,000 in cash.Assume that the equipment and long-term liabilities had fair values of $220,000 and $120,000, respectively, on the acquisition date.Chapman uses the initial value method to account for its investment.Prepare consolidation worksheet entries for December 31, 2011, and December 31, 2012.

التوضيح

Calculation of the fair value of net ide...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255