Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910 تمرين 28

Palm Company acquired 100 percent of Storm Company's voting stock on January 1, 2009, by issuing 10,000 shares of its $10 par value common stock (having a fair value of $14 per share).As of that date, Storm had stockholders' equity totaling $105,000.Land shown on Storm's accounting records was undervalued by $10,000.Equipment (with a five-year life) was undervalued by $5,000.A secret formula developed by Storm was appraised at $20,000 with an estimated life of 20 years.

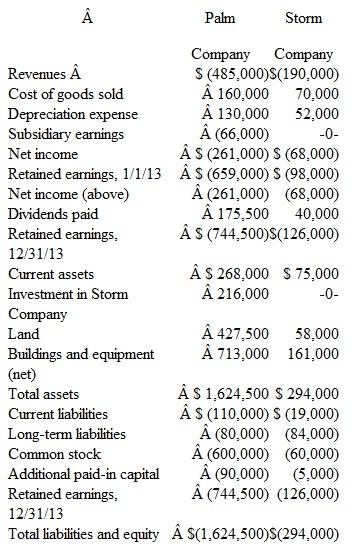

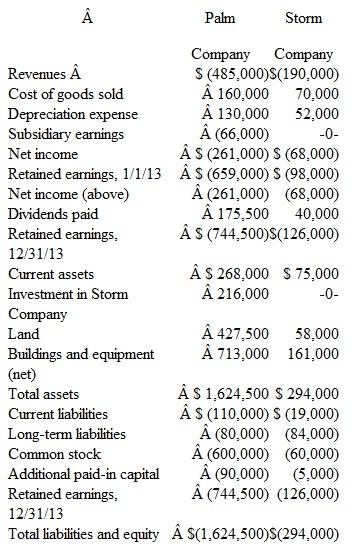

Following are the separate financial statements for the two companies for the year ending December 31,2013.Credit balances are indicated by parentheses. a. Explain how Palm derived the $66,000 balance in the Subsidiary Earnings account.

a. Explain how Palm derived the $66,000 balance in the Subsidiary Earnings account.

b. Prepare a worksheet to consolidate the financial information for these two companies.

c. Explain how Storm's individual financial records would differ if the push-down method of accounting had been applied.

Following are the separate financial statements for the two companies for the year ending December 31,2013.Credit balances are indicated by parentheses.

a. Explain how Palm derived the $66,000 balance in the Subsidiary Earnings account.

a. Explain how Palm derived the $66,000 balance in the Subsidiary Earnings account.b. Prepare a worksheet to consolidate the financial information for these two companies.

c. Explain how Storm's individual financial records would differ if the push-down method of accounting had been applied.

التوضيح

This problem requires knowledge of conso...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255