Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910 تمرين 2

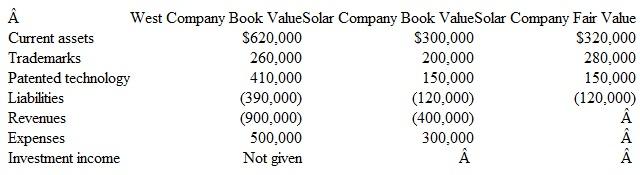

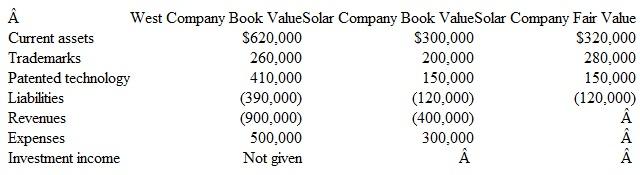

West Company acquired 60 percent of Solar Company for $300,000 when Solar's book value was $400,000.The newly comprised 40 percent noncontrolling interest had an assessed fair value of $200,000.Also at the acquisition date, Solar had a trademark (with a 10-year life) that was undervalued in the financial records by $60,000.Also, patented technology (with a 5-year life) was undervalued by $40,000.Two years later, the following figures are reported by these two companies (stockholders' equity accounts have been omitted):  What is the consolidated net income before allocation to the controlling and noncontrolling interests a.$400,000.

What is the consolidated net income before allocation to the controlling and noncontrolling interests a.$400,000.

B)$486,000.

C)$491,600.

D)$500,000.

What is the consolidated net income before allocation to the controlling and noncontrolling interests a.$400,000.

What is the consolidated net income before allocation to the controlling and noncontrolling interests a.$400,000.B)$486,000.

C)$491,600.

D)$500,000.

التوضيح

Step 1:

Calculate W Company's net income...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255