Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910 تمرين 5

Note: Problems 1 through 37 assume the use of the acquisition method.Problems 38 through 40 assume the use of the purchase method.

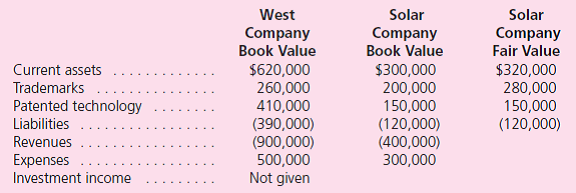

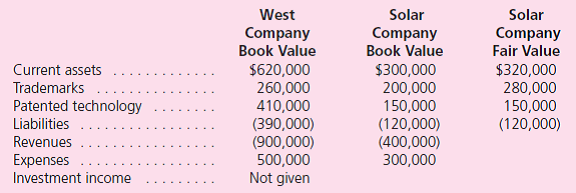

Use the following information for Problems 12 through 14:

West Company acquired 60 percent of Solar Company for $300,000 when Solar's book value was $400,000.The newly comprised 40 percent noncontrolling interest had an assessed fair value of $200,000.Also at the acquisition date, Solar had a trademark (with a 10-year life) that was undervalued in the financial records by $60,000.Also, patented technology (with a 5-year life) was undervalued by $40,000.Two years later, the following figures are reported by these two companies (stockholders' equity accounts have been omitted):

Assuming Solar Company has paid no dividends, what are the noncontrolling interest's share of the subsidiary's income and the ending balance of the noncontrolling interest in the subsidiary

a.$26,000 and $230,000.

b.$28,800 and $252,000.

c.$34,400 and $240,800.

d.$40,000 and $252,000.

Use the following information for Problems 12 through 14:

West Company acquired 60 percent of Solar Company for $300,000 when Solar's book value was $400,000.The newly comprised 40 percent noncontrolling interest had an assessed fair value of $200,000.Also at the acquisition date, Solar had a trademark (with a 10-year life) that was undervalued in the financial records by $60,000.Also, patented technology (with a 5-year life) was undervalued by $40,000.Two years later, the following figures are reported by these two companies (stockholders' equity accounts have been omitted):

Assuming Solar Company has paid no dividends, what are the noncontrolling interest's share of the subsidiary's income and the ending balance of the noncontrolling interest in the subsidiary

a.$26,000 and $230,000.

b.$28,800 and $252,000.

c.$34,400 and $240,800.

d.$40,000 and $252,000.

التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255