Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910 تمرين 8

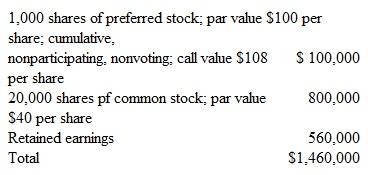

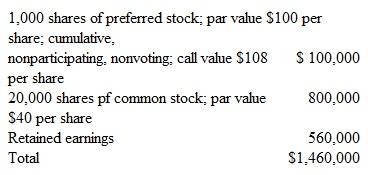

On January 1, Morgan Company has a net book value of $1,460,000 as follows:  Leinen Company acquires all outstanding preferred shares for $106,000 and 60 percent pf the common stock for $870,000.The acquisition-date fair value of the noncontrolling interest in Morgan's common stock was $580,000.Leinen believed that one of Morgan's buildings, with a 12-year life, was undervalued by $50,000 on the company's financial records.

Leinen Company acquires all outstanding preferred shares for $106,000 and 60 percent pf the common stock for $870,000.The acquisition-date fair value of the noncontrolling interest in Morgan's common stock was $580,000.Leinen believed that one of Morgan's buildings, with a 12-year life, was undervalued by $50,000 on the company's financial records.

What amount of consolidated goodwill would be recognized from this acquisition

a.$40,000.

b.$41,200

c.$42,400.

d.$46,000.

Leinen Company acquires all outstanding preferred shares for $106,000 and 60 percent pf the common stock for $870,000.The acquisition-date fair value of the noncontrolling interest in Morgan's common stock was $580,000.Leinen believed that one of Morgan's buildings, with a 12-year life, was undervalued by $50,000 on the company's financial records.

Leinen Company acquires all outstanding preferred shares for $106,000 and 60 percent pf the common stock for $870,000.The acquisition-date fair value of the noncontrolling interest in Morgan's common stock was $580,000.Leinen believed that one of Morgan's buildings, with a 12-year life, was undervalued by $50,000 on the company's financial records.What amount of consolidated goodwill would be recognized from this acquisition

a.$40,000.

b.$41,200

c.$42,400.

d.$46,000.

التوضيح

D.

Consideration transferred for preferr...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255