Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910 تمرين 55

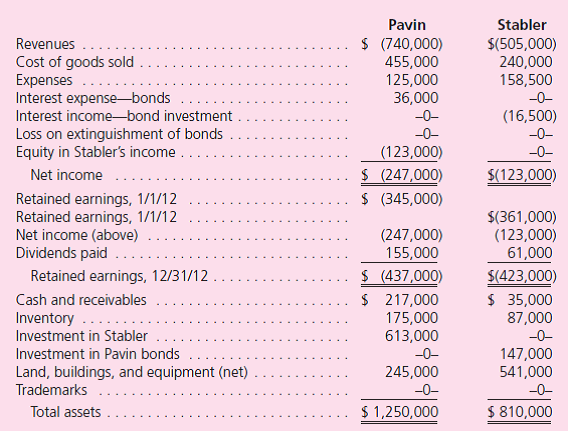

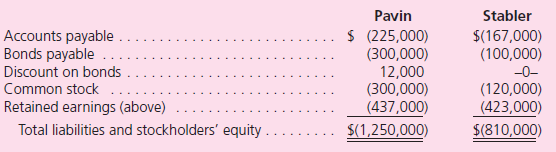

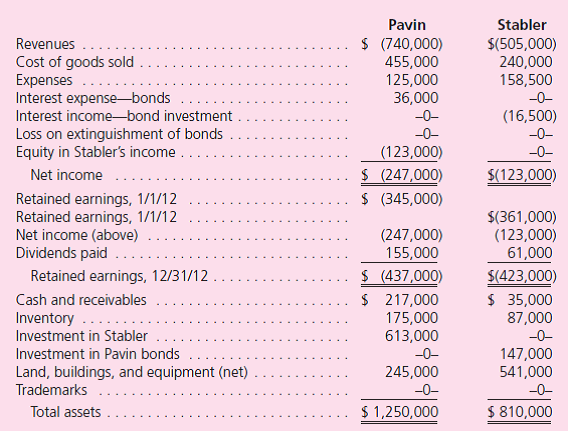

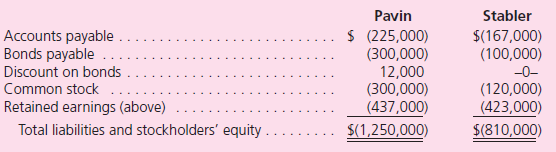

Pavin acquires all of Stabler's outstanding shares on January 1, 2009, for $460,000 in cash.Of this amount, $30,000 was attributed to equipment with a 10-year remaining life and $40,000 was assigned to trademarks expensed over a 20-year period.Pavin applies the partial equity method so that income is accrued each period based solely on the earnings reported by the subsidiary.

On January 1, 2012, Pavin reports $300,000 in bonds outstanding with a book value of $282,000.Stabler purchases half of these bonds on the open market for $145,500.During 2012, Pavin begins to sell merchandise to Stabler.During that year, inventory costing $80,000 was transferred at a price of $100,000.All but $10,000 (at sales price) of these goods were resold to outside parties by year-end.Stabler still owes $33,000 for inventory shipped from Pavin during December.

The following financial figures are for the two companies for the year ending December 31, 2012.Prepare a worksheet to produce consolidated balances.(Credits are indicated by parentheses.)

On January 1, 2012, Pavin reports $300,000 in bonds outstanding with a book value of $282,000.Stabler purchases half of these bonds on the open market for $145,500.During 2012, Pavin begins to sell merchandise to Stabler.During that year, inventory costing $80,000 was transferred at a price of $100,000.All but $10,000 (at sales price) of these goods were resold to outside parties by year-end.Stabler still owes $33,000 for inventory shipped from Pavin during December.

The following financial figures are for the two companies for the year ending December 31, 2012.Prepare a worksheet to produce consolidated balances.(Credits are indicated by parentheses.)

التوضيح

Acquisition-date fair-value allocation a...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255