Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910 تمرين 3

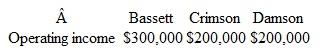

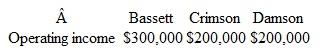

Bassett Company owns 80 percent of Crimson and Crimson owns 90 percent of Damson, Inc.Operating income totals for the current year follow; they contain no investment income.None of these acquisitions required amortization expense.Included in Damson's income is a $40,000 unrealized gain on intra-entity transfers to Crimson.  What is Bassett's accrual-based income for the year

What is Bassett's accrual-based income for the year

a.$575,200.

b.$588,000.

c.$596,400.

d.$604,000.

What is Bassett's accrual-based income for the year

What is Bassett's accrual-based income for the year a.$575,200.

b.$588,000.

c.$596,400.

d.$604,000.

التوضيح

B Company owns 80% of the voting stock i...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255