Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910 تمرين 4

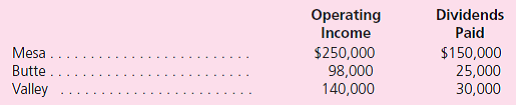

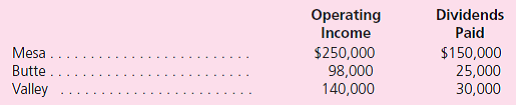

Mesa, Inc., obtained 80 percent of Butte Corporation on January 1, 2009.Annual amortization of $22,500 is to be recorded on the allocations of Butte's acquisition-date business fair value.On January 1, 2010, Butte acquired 55 percent of Valley Company's voting stock.Excess business fairvalue amortization on this second acquisition amounted to $8,000 per year.For 2011, each of the three companies reported the following information accumulated by its separate accounting system.Operating income figures do not include any investment or dividend income.

a.What is consolidated net income for 2011

b.How is consolidated net income distributed to the controlling and noncontrolling interests

a.What is consolidated net income for 2011

b.How is consolidated net income distributed to the controlling and noncontrolling interests

التوضيح

Consolidated net income:

This is the in...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255