Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910 تمرين 18

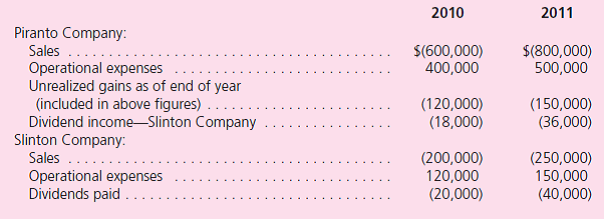

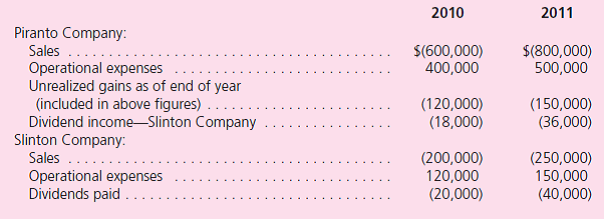

On January 1, 2010, Piranto acquires 90 percent of Slinton's outstanding shares.Financial information for these two companies for the years of 2010 and 2011 follows:

Assume that a tax rate of 40 percent is applicable to both companies.

a.On consolidated financial statements for 2011, what are the income tax expense and the income tax currently payable if Piranto and Slinton file a consolidated tax return as an affiliated group

b.On consolidated financial statements for 2011, what are the income tax expense and income tax currently payable for each company if they choose to file separate returns

Assume that a tax rate of 40 percent is applicable to both companies.

a.On consolidated financial statements for 2011, what are the income tax expense and the income tax currently payable if Piranto and Slinton file a consolidated tax return as an affiliated group

b.On consolidated financial statements for 2011, what are the income tax expense and income tax currently payable for each company if they choose to file separate returns

التوضيح

Consolidated balance sheet:

The consoli...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255