Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910 تمرين 39

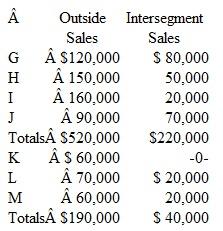

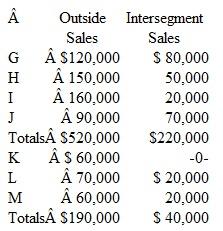

Medford Company has seven operating segments but only four (G, H, I, and J) are of significant size to warrant separate disclosure.As a whole, the segments generated revenues of $710,000 ($520,000 + $190,000) from outside parties.In addition, the segments had $260,000 in intersegment transfers ($220,000 + $40,000).  Which of the following statements is true

Which of the following statements is true

a.A sufficient number of segments are being reported because those segments have $740,000 in revenues of a total of $970,000 for the company as a whole.

b.Not enough segments are being reported because those segments have $520,000 in outside sales of a total of $710,000 for the company as a whole.

c.Not enough segments are being reported because those segments have $740,000 in revenues of a total of $970,000 for the company as a whole.

d.A sufficient number of segments are being reported because those segments have $520,000 in outside sales of a total of $710,000 for the company as a whole.

Which of the following statements is true

Which of the following statements is true a.A sufficient number of segments are being reported because those segments have $740,000 in revenues of a total of $970,000 for the company as a whole.

b.Not enough segments are being reported because those segments have $520,000 in outside sales of a total of $710,000 for the company as a whole.

c.Not enough segments are being reported because those segments have $740,000 in revenues of a total of $970,000 for the company as a whole.

d.A sufficient number of segments are being reported because those segments have $520,000 in outside sales of a total of $710,000 for the company as a whole.

التوضيح

This problem requires knowledge of repor...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255