Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910 تمرين 47

Use the following information for Problems 15 through 17.

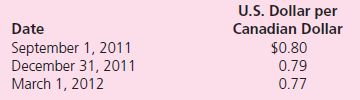

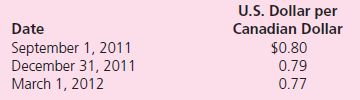

On September 1, 2011, Jensen Company received an order to sell a machine to a customer in Canada at a price of 100,000 Canadian dollars.Jensen shipped the machine and received payment on March 1, 2012.On September 1, 2011, Jensen purchased a put option giving it the right to sell 100,000 Canadian dollars on March 1, 2012, at a price of $80,000.Jensen properly designated the option as a fair value hedge of the Canadian dollar firm commitment.The option cost $2,000 and had a fair value of $2,300 on December 31, 2011.The fair value of the firm commitment was measured by referring to changes in the spot rate.The following spot exchange rates apply:

Jensen Company's incremental borrowing rate is 12 percent.The present value factor for two months at an annual interest rate of 12 percent (1 percent per month) is 0.9803.

What was the net impact on Jensen Company's 2012 income as a result of this fair value hedge of a firm commitment

a.$-0-.

b.$1,319.70 decrease in income.

c.$77,980.30 increase in income.

d.$78,680.30 increase in income.

On September 1, 2011, Jensen Company received an order to sell a machine to a customer in Canada at a price of 100,000 Canadian dollars.Jensen shipped the machine and received payment on March 1, 2012.On September 1, 2011, Jensen purchased a put option giving it the right to sell 100,000 Canadian dollars on March 1, 2012, at a price of $80,000.Jensen properly designated the option as a fair value hedge of the Canadian dollar firm commitment.The option cost $2,000 and had a fair value of $2,300 on December 31, 2011.The fair value of the firm commitment was measured by referring to changes in the spot rate.The following spot exchange rates apply:

Jensen Company's incremental borrowing rate is 12 percent.The present value factor for two months at an annual interest rate of 12 percent (1 percent per month) is 0.9803.

What was the net impact on Jensen Company's 2012 income as a result of this fair value hedge of a firm commitment

a.$-0-.

b.$1,319.70 decrease in income.

c.$77,980.30 increase in income.

d.$78,680.30 increase in income.

التوضيح

Foreign currency transaction:

It refers...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255