Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910 تمرين 18

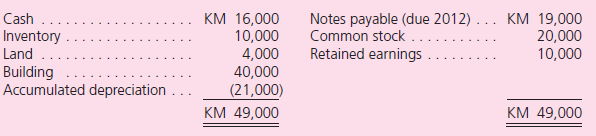

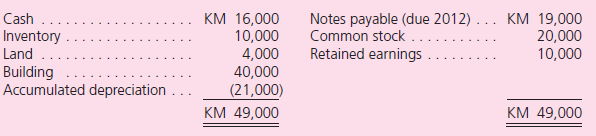

Watson Company has a subsidiary in the country of Alonza where the local currency unit is the kamel (KM).On December 31, 2010, the subsidiary has the following balance sheet:

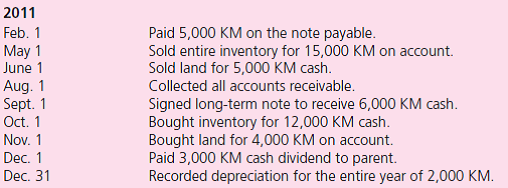

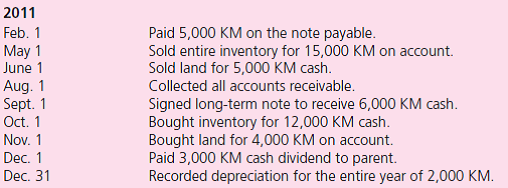

The subsidiary acquired the inventory on August 1, 2010, and the land and buildings in 2000.It issued the common stock in 1998.During 2011, the following transactions took place:

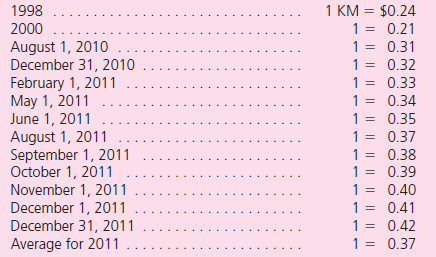

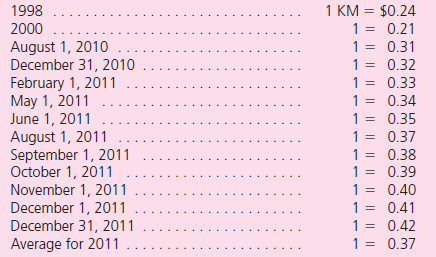

The exchange rates for 1 KM are as follows:

a.If this is a translation, what is the translation adjustment determined solely for 2011

b.If this is a remeasurement, what is the remeasurement gain or loss determined solely for 2011

The subsidiary acquired the inventory on August 1, 2010, and the land and buildings in 2000.It issued the common stock in 1998.During 2011, the following transactions took place:

The exchange rates for 1 KM are as follows:

a.If this is a translation, what is the translation adjustment determined solely for 2011

b.If this is a remeasurement, what is the remeasurement gain or loss determined solely for 2011

التوضيح

Financial statements:

These statements ...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255