Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910 تمرين 22

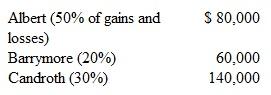

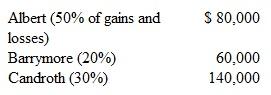

A partnership has the following capital balances:  Danville is going to invest $70,000 into the business to acquire a 30 percent ownership interest Goodwill is to be recorded.What will be Danville's beginning capital balance

Danville is going to invest $70,000 into the business to acquire a 30 percent ownership interest Goodwill is to be recorded.What will be Danville's beginning capital balance

a.$70,000.

b.$90,000.

c.$105,000.

d.$120,000.

Danville is going to invest $70,000 into the business to acquire a 30 percent ownership interest Goodwill is to be recorded.What will be Danville's beginning capital balance

Danville is going to invest $70,000 into the business to acquire a 30 percent ownership interest Goodwill is to be recorded.What will be Danville's beginning capital balance a.$70,000.

b.$90,000.

c.$105,000.

d.$120,000.

التوضيح

Answer: Option b).$90,000

Danv...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255