Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910 تمرين 8

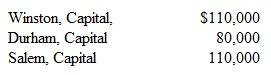

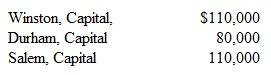

A partnership begins its first year of operations with the following capital balances:  According to the articles of partnership, all profits will be assigned as follows:

According to the articles of partnership, all profits will be assigned as follows:

• Winston will be awarded an annual salary of $20,000 with $ 10,000 assigned to Salem.

• The partners will be attributed interest equal to 10 percent of the capital balance as of the first day of the year.

• The remainder will be assigned on a 5:2:3 basis, respectively.

• Each partner is allowed to withdraw up to $ 10,000 per year.

The net loss for the first year of operations is $20,000 and net income for the subsequent year is $40,000.Each partner withdraws the maximum amount from the business each period.What is the balance in Winston's capital account at the end of the second year

a.$102,600.

b.$104,400.

c.$108,600.

d.$109,200,

According to the articles of partnership, all profits will be assigned as follows:

According to the articles of partnership, all profits will be assigned as follows:• Winston will be awarded an annual salary of $20,000 with $ 10,000 assigned to Salem.

• The partners will be attributed interest equal to 10 percent of the capital balance as of the first day of the year.

• The remainder will be assigned on a 5:2:3 basis, respectively.

• Each partner is allowed to withdraw up to $ 10,000 per year.

The net loss for the first year of operations is $20,000 and net income for the subsequent year is $40,000.Each partner withdraws the maximum amount from the business each period.What is the balance in Winston's capital account at the end of the second year

a.$102,600.

b.$104,400.

c.$108,600.

d.$109,200,

التوضيح

Given data can be summarized as below: ...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255