Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910 تمرين 48

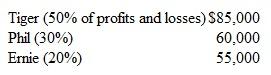

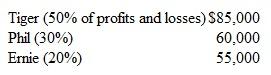

The Distance Plus partnership has the following capital balances at the beginning of the current year:  Each of the following questions should be viewed independently.

Each of the following questions should be viewed independently.

a.If Sergio invests $100,000 in cash in the business for a 25 percent interest, what journal entry is recorded Assume that the bonus method isused.

b.If Sergio invests $60.000 in cash in the business for a 25 percent interest, what journal entry is recorded Assume that the bonus method is used.

c.If Sergio invests $72,000 in cash in the business for a 25 percent interest, what journal entry is recorded Assume that the goodwill method is used.

Each of the following questions should be viewed independently.

Each of the following questions should be viewed independently.a.If Sergio invests $100,000 in cash in the business for a 25 percent interest, what journal entry is recorded Assume that the bonus method isused.

b.If Sergio invests $60.000 in cash in the business for a 25 percent interest, what journal entry is recorded Assume that the bonus method is used.

c.If Sergio invests $72,000 in cash in the business for a 25 percent interest, what journal entry is recorded Assume that the goodwill method is used.

التوضيح

a.

The amount of total capital is after...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255