Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910 تمرين 25

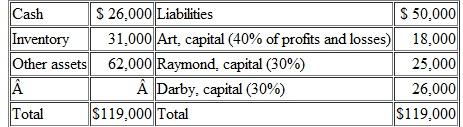

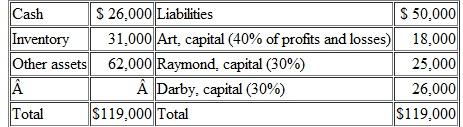

A partnership has the following balance sheet just before final liquidation is to begin:  Liquidation expenses are estimated to be $12,000.The other assets are sold for $40,000.What distribution can be made to the partners a.-0-to Art, $1,500 to Raymond, $2,500 to Darby.

Liquidation expenses are estimated to be $12,000.The other assets are sold for $40,000.What distribution can be made to the partners a.-0-to Art, $1,500 to Raymond, $2,500 to Darby.

B)$1,333 to Art, $1,333 to Raymond, $1,334 to Darby.

C)-0- to Art, $ 1,200 to Raymond, $2,800 to Darby.

D)$600 to Art, $1,200 to Raymond, $2,200 to Darby.

Liquidation expenses are estimated to be $12,000.The other assets are sold for $40,000.What distribution can be made to the partners a.-0-to Art, $1,500 to Raymond, $2,500 to Darby.

Liquidation expenses are estimated to be $12,000.The other assets are sold for $40,000.What distribution can be made to the partners a.-0-to Art, $1,500 to Raymond, $2,500 to Darby.B)$1,333 to Art, $1,333 to Raymond, $1,334 to Darby.

C)-0- to Art, $ 1,200 to Raymond, $2,800 to Darby.

D)$600 to Art, $1,200 to Raymond, $2,200 to Darby.

التوضيح

Thus, the amounts that would be distribu...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255