Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910 تمرين 5

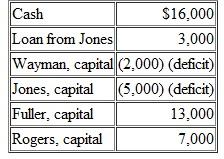

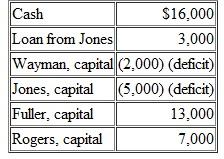

A partnership has gone through liquidation and now reports the following account balances:  Profits and losses are allocated on the following basis: Wayman, 30 percent; Jones, 20 percent; Fuller, 30 percent; and Rogers, 20 percent.Which of the following events should occur now

Profits and losses are allocated on the following basis: Wayman, 30 percent; Jones, 20 percent; Fuller, 30 percent; and Rogers, 20 percent.Which of the following events should occur now

a.Jones should receive $3,000 cash because of the loan balance.

b.Fuller should receive $11,800 and Rogers $4,200.

c.Fuller should receive $10,600 and Rogers $5,400.

d.Jones should receive $3,000, Fuller $8,800, and Rogers $4,200,

Profits and losses are allocated on the following basis: Wayman, 30 percent; Jones, 20 percent; Fuller, 30 percent; and Rogers, 20 percent.Which of the following events should occur now

Profits and losses are allocated on the following basis: Wayman, 30 percent; Jones, 20 percent; Fuller, 30 percent; and Rogers, 20 percent.Which of the following events should occur now a.Jones should receive $3,000 cash because of the loan balance.

b.Fuller should receive $11,800 and Rogers $4,200.

c.Fuller should receive $10,600 and Rogers $5,400.

d.Jones should receive $3,000, Fuller $8,800, and Rogers $4,200,

التوضيح

Explanation :

The calculation of ending...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255