Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910 تمرين 11

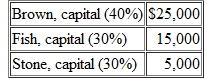

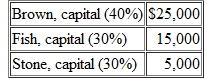

A local partnership has only two assets (cash of $10,000 and land with a cost of $35,000).All liabilities have been paid and the following capital balances are currently being recorded.The partners share profits and losses as follows.All partners are insolvent.  a.If the land is sold for $25,000, how much cash does each partner receive in a final settlement

a.If the land is sold for $25,000, how much cash does each partner receive in a final settlement

b.If the land is sold for $15,000, how much cash does each partner receive in a final settlement

c.If the land is sold for $5,000, how much cash does each partner receive in a final settlement

a.If the land is sold for $25,000, how much cash does each partner receive in a final settlement

a.If the land is sold for $25,000, how much cash does each partner receive in a final settlement b.If the land is sold for $15,000, how much cash does each partner receive in a final settlement

c.If the land is sold for $5,000, how much cash does each partner receive in a final settlement

التوضيح

Given data can be summarized a...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255