Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910 تمرين 3

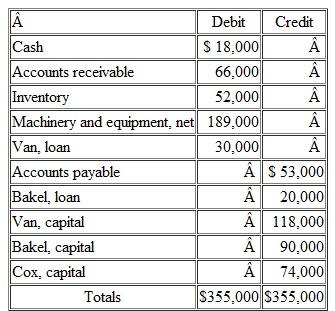

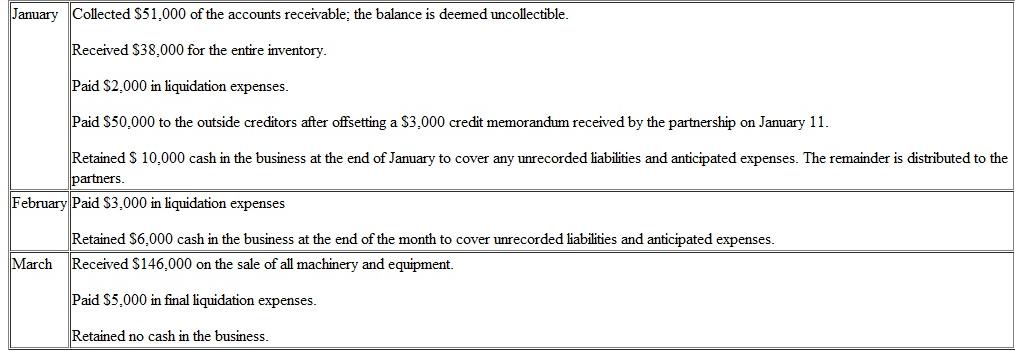

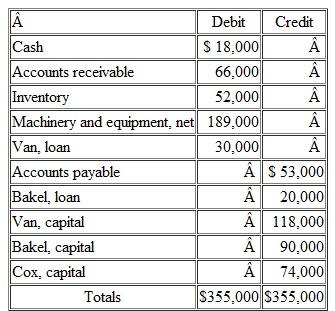

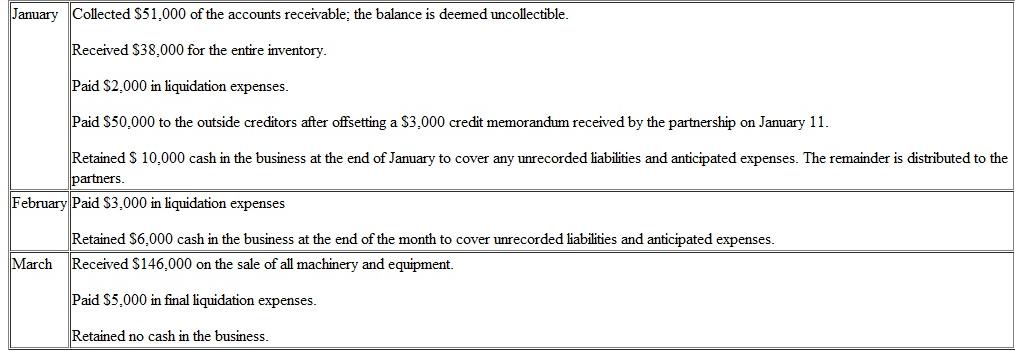

On January 1, the partners of Van, Bakel, and Cox (who share profits and losses in the ratio of 5:3:2, respectively) decide to liquidate their partnership.The trial balance at this date follows:  The partners plan a program of piecemeal conversion of the business's assets to minimize liquidation losses.All available cash, less an amount retained to provide for future expenses, is to be distributed to the partners at the end of each month.A summary of the liquidation transactions follows:

The partners plan a program of piecemeal conversion of the business's assets to minimize liquidation losses.All available cash, less an amount retained to provide for future expenses, is to be distributed to the partners at the end of each month.A summary of the liquidation transactions follows:  Prepare a schedule to compute the safe installment payments made to the partners at the end of each of these three months.

Prepare a schedule to compute the safe installment payments made to the partners at the end of each of these three months.

The partners plan a program of piecemeal conversion of the business's assets to minimize liquidation losses.All available cash, less an amount retained to provide for future expenses, is to be distributed to the partners at the end of each month.A summary of the liquidation transactions follows:

The partners plan a program of piecemeal conversion of the business's assets to minimize liquidation losses.All available cash, less an amount retained to provide for future expenses, is to be distributed to the partners at the end of each month.A summary of the liquidation transactions follows:  Prepare a schedule to compute the safe installment payments made to the partners at the end of each of these three months.

Prepare a schedule to compute the safe installment payments made to the partners at the end of each of these three months.التوضيح

This problem requires knowledge of safe ...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255