Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910 تمرين 40

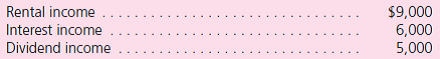

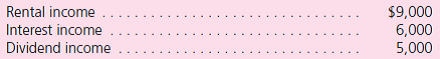

During 2010, an estate generated income of $20,000:

The interest income is conveyed immediately to the beneficiary stated in the decedent's will.Dividends of $1,200 are given to the decedent's church.

What amount of federal income tax must this estate pay

The interest income is conveyed immediately to the beneficiary stated in the decedent's will.Dividends of $1,200 are given to the decedent's church.

What amount of federal income tax must this estate pay

التوضيح

Income tax:

The income tax is referred ...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255