Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

النسخة 10الرقم المعياري الدولي: 978-1260575910 تمرين 55

Jerry Tasch's will has the following provisions:

• $150,000 in cash goes to Thomas Thorne.

• All shares of Coca-Cola go to Cindy Phillips.

• Residence goes to Kevin Simmons.

• All other estate assets are to be liquidated with the resulting cash going to the First Church of Freedom, Missouri.

Prepare journal entries for the following transactions:

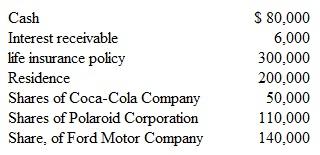

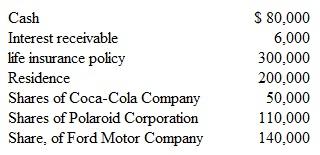

a.Discovered the following assets(at fair value): b.Collected interest of $7,000.

b.Collected interest of $7,000.

c.Paid funeral expenses of $20,000.

d.Discovered debts of $40,000.

e.Located an additional savings account of $ 12,000.

f.Conveyed title to the residence to Kevin Simmons,

g.Collected life insurance policy.

h.Discovered additional debts of $60,000.Paid debts totaling $100,000.

i Conveyed cash of SI5O,ooo to appropriate beneficiary.

j.Sold the shares of Polaroid for $112,000.

k.Paid administrative expenses of $10,000.

• $150,000 in cash goes to Thomas Thorne.

• All shares of Coca-Cola go to Cindy Phillips.

• Residence goes to Kevin Simmons.

• All other estate assets are to be liquidated with the resulting cash going to the First Church of Freedom, Missouri.

Prepare journal entries for the following transactions:

a.Discovered the following assets(at fair value):

b.Collected interest of $7,000.

b.Collected interest of $7,000.c.Paid funeral expenses of $20,000.

d.Discovered debts of $40,000.

e.Located an additional savings account of $ 12,000.

f.Conveyed title to the residence to Kevin Simmons,

g.Collected life insurance policy.

h.Discovered additional debts of $60,000.Paid debts totaling $100,000.

i Conveyed cash of SI5O,ooo to appropriate beneficiary.

j.Sold the shares of Polaroid for $112,000.

k.Paid administrative expenses of $10,000.

التوضيح

a) Calculate the estate principal: Writ...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255