Cost Management: A Strategic Emphasis 7th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

النسخة 7الرقم المعياري الدولي: 978-0077733773

Cost Management: A Strategic Emphasis 7th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

النسخة 7الرقم المعياري الدولي: 978-0077733773 تمرين 6

A company purchases an asset that costs $10,000. This asset qualifies as three-year property under MACRS. The company uses an after-tax discount rate of 12% and faces a 40% income tax rate. Use the appropriate present value factors found in Appendix C, Table 1, to determine the present value of the depreciation deductions for this firm over the specified four-year period.

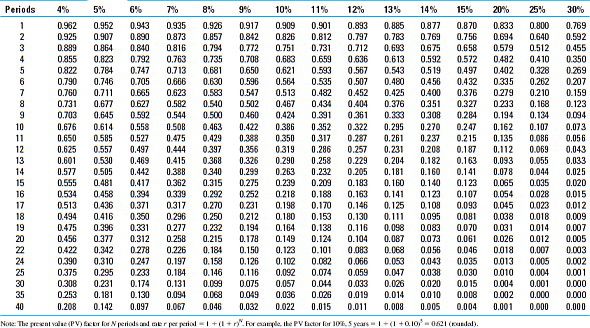

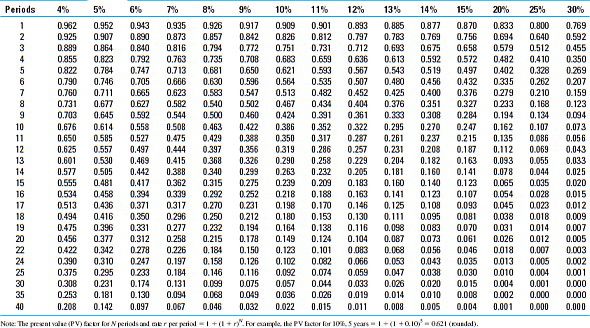

Table 1 Present Value of $1

Table 1 Present Value of $1

التوضيح

The computation of present value of depr...

Cost Management: A Strategic Emphasis 7th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255