Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 44

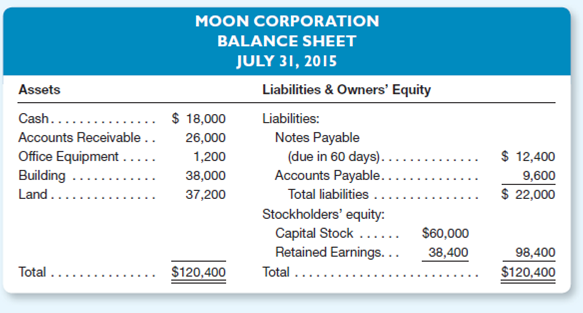

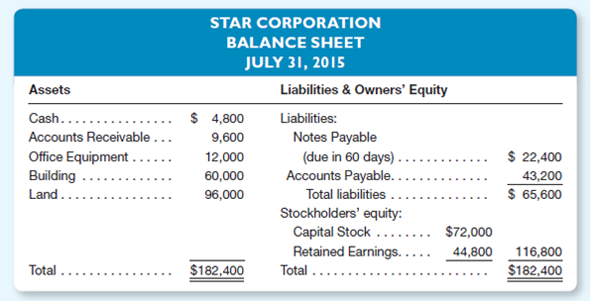

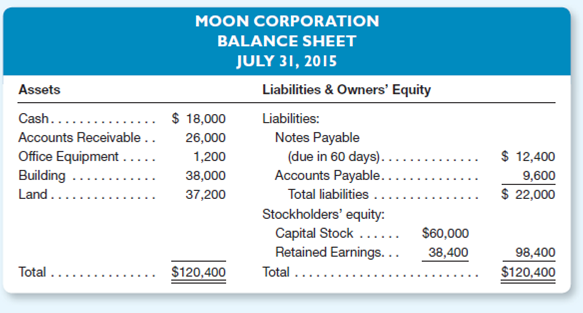

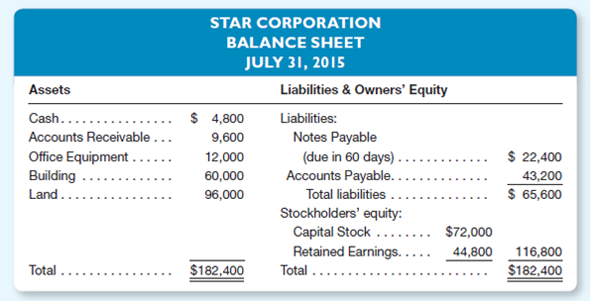

Moon Corporation and Star Corporation are in the same line of business and both were recently organized, so it may be assumed that the recorded costs for assets are close to current market values.he balance sheets for the two companies are as follows at July 31, 2015:

Instructions

a.ssume that you are a banker and that each company has applied to you for a 90-day loan of $12,000.hich would you consider to be the more favorable prospect Explain your answer fully.

b.ssume that you are an investor considering purchasing all the capital stock of one or both of the companies.or which business would you be willing to pay the higher price Do you see any indication of a financial crisis that you might face shortly after buying either company Explain your answer fully.For either decision, additional information would be useful, but you are to reach your decision on the basis of the information available.)

Instructions

a.ssume that you are a banker and that each company has applied to you for a 90-day loan of $12,000.hich would you consider to be the more favorable prospect Explain your answer fully.

b.ssume that you are an investor considering purchasing all the capital stock of one or both of the companies.or which business would you be willing to pay the higher price Do you see any indication of a financial crisis that you might face shortly after buying either company Explain your answer fully.For either decision, additional information would be useful, but you are to reach your decision on the basis of the information available.)

التوضيح

Financial reporting means reporting fina...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255