Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 29

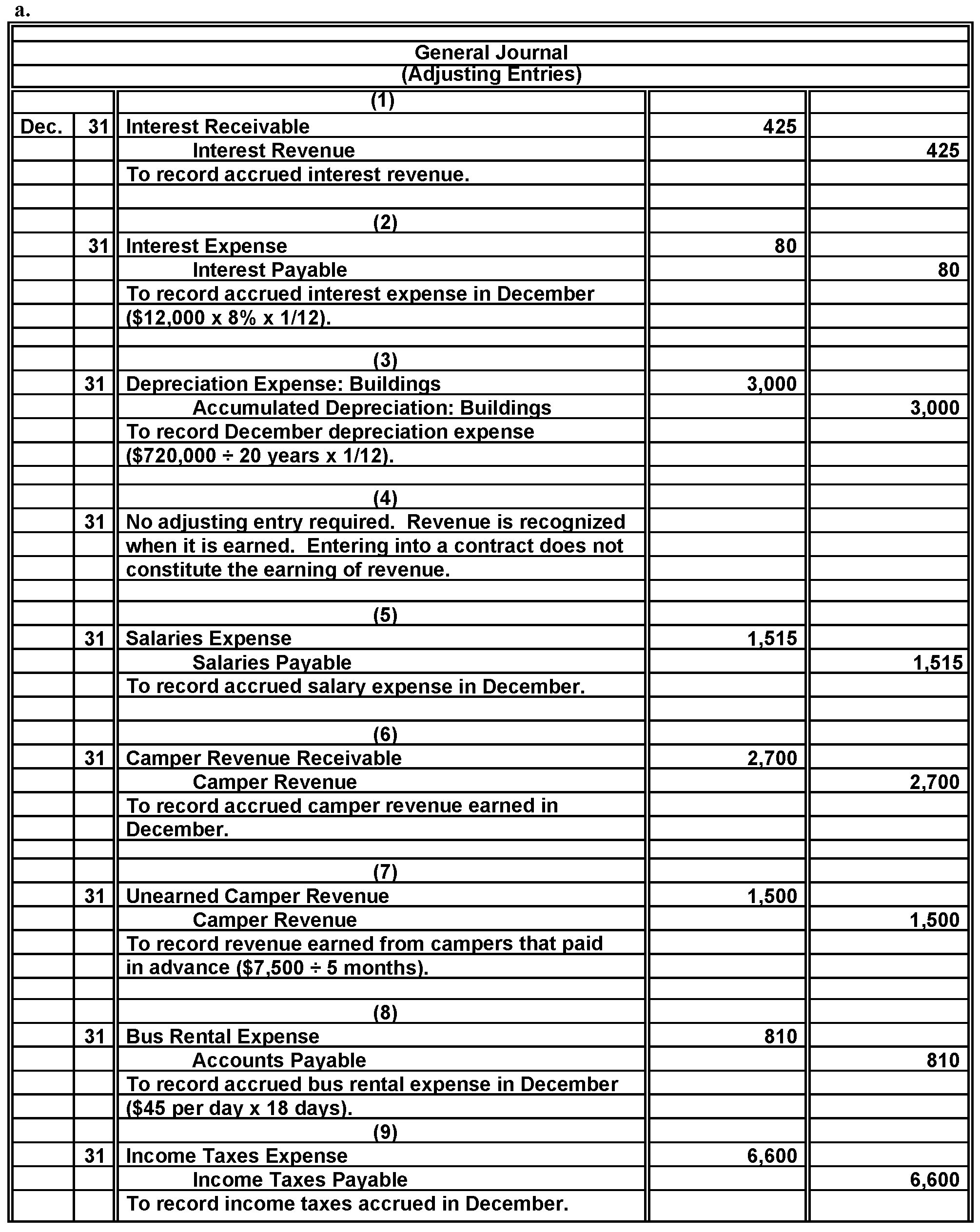

Preparing and Analyzing the Effects of Adjusting Entries

Big Oaks, a large campground in Vermont, adjusts its accounts monthly and closes its accounts annually on December 31.ost guests of the campground pay at the time they check out, and the amounts collected are credited to Camper Revenue.he following information is available as a source for preparing the adjusting entries at December 31:

1.ig Oaks invests some of its excess cash in certificates of deposit (CDs) with its local bank.ccrued interest revenue on its CDs at December 31 is $425.one of the interest has yet been received.Debit Interest Receivable.)

2.n eight-month bank loan in the amount of $12,000 had been obtained on October 1.nterest is to be computed at an annual rate of 8 percent and is payable when the loan becomes due.

3.epreciation on buildings owned by the campground is based on a 20-year life.he original cost of the buildings was $720,000.he Accumulated Depreciation: Buildings account has a credit balance of $160,000 at December 31, prior to the adjusting entry process.he straight- line method of depreciation is used.

4.anagement signed an agreement to let Girl Scouts from Easton, Connecticut, use the campground in June of next year.he agreement specifies that the Girl Scouts will pay a daily rate of $15 per campsite, with a clause providing a minimum total charge of $1,200.

5.alaries earned by campground employees that have not yet been paid amount to $1,515.

6.s of December 31, Big Oaks has earned $2,700 of revenue from current campers who will not be billed until they check out.Debit Camper Revenue Receivable.)

7.everal lakefront campsites are currently being leased on a long-term basis by a group of senior citizens.ive months' rent ci $7,500 was collected in advance and credited to Unearned Camper Revenue on November 1 of the current year.

8. bus to carry campers to and from town and the airport had been rented the first week of December at a daily rate of $45.t December 31, no rental payment has been made, although the campground has had use of the bus for 18 days.

9.nrecorded Income Taxes Expense accrued in December amounts to $6,600.his amount will not be paid until January 15.

Instructions

a.or each of the above numbered paragraphs, prepare the necessary adjusting entry (including an explanation).f no adjusting entry is required, explain why.

b.our types cf adjusting entries are described at the beginning of the chapter.sing these descriptions, identify the type of each adjusting entry prepared in part a above.

c.ndicate the effects that each of the adjustments in part a will have on the following six total amounts in the campground's financial statements for the month of December.rganize your answer in tabular form, using the column headings shown below.se the letters 1 for increase, D for decrease, and NE for no effect.djusting entry 1 is provided as an example.

d.hat is the amount of interest expense recognized for the entire current year on the $12,000 bank loan obtained October 1

e.ompute the book value of the campground's buildings to be reported in the current year's December 31 balance sheet.Refer to paragraph 3.)

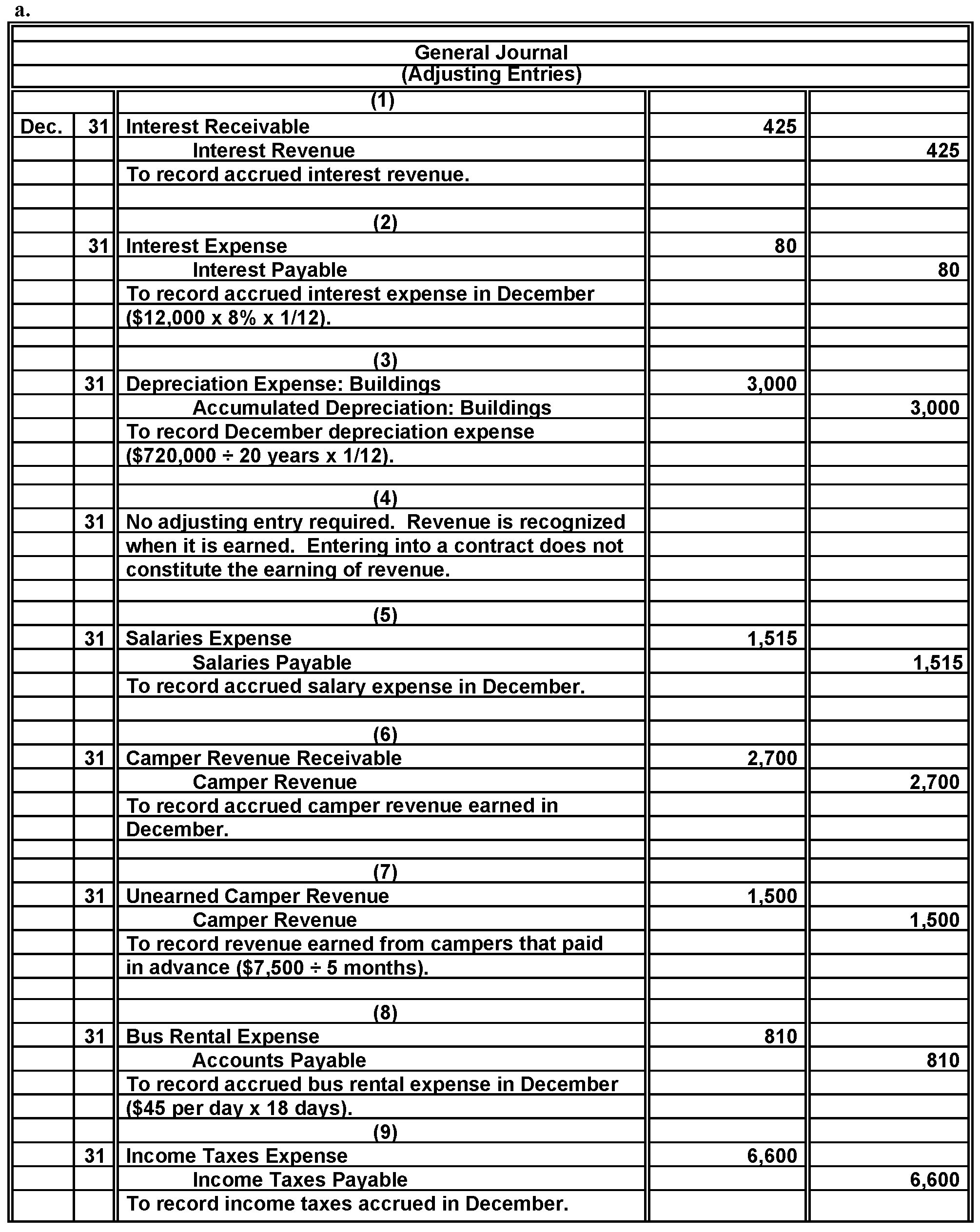

Big Oaks, a large campground in Vermont, adjusts its accounts monthly and closes its accounts annually on December 31.ost guests of the campground pay at the time they check out, and the amounts collected are credited to Camper Revenue.he following information is available as a source for preparing the adjusting entries at December 31:

1.ig Oaks invests some of its excess cash in certificates of deposit (CDs) with its local bank.ccrued interest revenue on its CDs at December 31 is $425.one of the interest has yet been received.Debit Interest Receivable.)

2.n eight-month bank loan in the amount of $12,000 had been obtained on October 1.nterest is to be computed at an annual rate of 8 percent and is payable when the loan becomes due.

3.epreciation on buildings owned by the campground is based on a 20-year life.he original cost of the buildings was $720,000.he Accumulated Depreciation: Buildings account has a credit balance of $160,000 at December 31, prior to the adjusting entry process.he straight- line method of depreciation is used.

4.anagement signed an agreement to let Girl Scouts from Easton, Connecticut, use the campground in June of next year.he agreement specifies that the Girl Scouts will pay a daily rate of $15 per campsite, with a clause providing a minimum total charge of $1,200.

5.alaries earned by campground employees that have not yet been paid amount to $1,515.

6.s of December 31, Big Oaks has earned $2,700 of revenue from current campers who will not be billed until they check out.Debit Camper Revenue Receivable.)

7.everal lakefront campsites are currently being leased on a long-term basis by a group of senior citizens.ive months' rent ci $7,500 was collected in advance and credited to Unearned Camper Revenue on November 1 of the current year.

8. bus to carry campers to and from town and the airport had been rented the first week of December at a daily rate of $45.t December 31, no rental payment has been made, although the campground has had use of the bus for 18 days.

9.nrecorded Income Taxes Expense accrued in December amounts to $6,600.his amount will not be paid until January 15.

Instructions

a.or each of the above numbered paragraphs, prepare the necessary adjusting entry (including an explanation).f no adjusting entry is required, explain why.

b.our types cf adjusting entries are described at the beginning of the chapter.sing these descriptions, identify the type of each adjusting entry prepared in part a above.

c.ndicate the effects that each of the adjustments in part a will have on the following six total amounts in the campground's financial statements for the month of December.rganize your answer in tabular form, using the column headings shown below.se the letters 1 for increase, D for decrease, and NE for no effect.djusting entry 1 is provided as an example.

d.hat is the amount of interest expense recognized for the entire current year on the $12,000 bank loan obtained October 1

e.ompute the book value of the campground's buildings to be reported in the current year's December 31 balance sheet.Refer to paragraph 3.)

التوضيح

b.Accruing uncollected revenue. Accruin...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255