Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 55

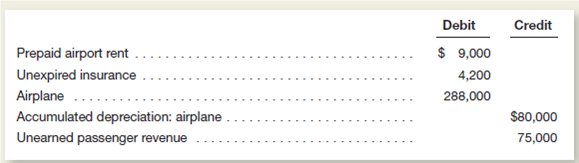

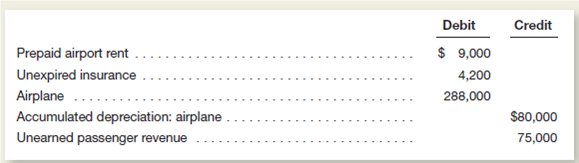

Gunflint Adventures operates an airplane service that takes fishing parties to a remote lake resort in northern Manitoba, Canada.ndividuals must purchase their tickets at least one month in advance during the busy summer season.he company adjusts its accounts only once each month.elected balances appearing in the company's June 30 adjusted trial balance appear as follows:

Other Information

1.he airplane is being depreciated over a 15-year life with no residual value.

2.nearned passenger revenue represents advance ticket sales for bookings in July and August

at $300 per ticket.

3.ix months' airport rent had been prepaid on May 1.

4.he unexpired insurance is what remains of a 12-month policy purchased on February 1.

5.assenger revenue earned in June totaled $40,000.

Instructions

a.etermine the following:

1.he age of the airplane in months.

2.he monthly airport rent expense.

3.he amount paid for the 12-month insurance policy on February 1.

b.repare the adjusting entries made on June 30 involving the following accounts:

1.epreciation Expense: Airplane

2.irport Rent Expense

3.nsurance Expense

4.assenger Revenue Earned

Other Information

1.he airplane is being depreciated over a 15-year life with no residual value.

2.nearned passenger revenue represents advance ticket sales for bookings in July and August

at $300 per ticket.

3.ix months' airport rent had been prepaid on May 1.

4.he unexpired insurance is what remains of a 12-month policy purchased on February 1.

5.assenger revenue earned in June totaled $40,000.

Instructions

a.etermine the following:

1.he age of the airplane in months.

2.he monthly airport rent expense.

3.he amount paid for the 12-month insurance policy on February 1.

b.repare the adjusting entries made on June 30 involving the following accounts:

1.epreciation Expense: Airplane

2.irport Rent Expense

3.nsurance Expense

4.assenger Revenue Earned

التوضيح

A balance sheet depicts two types of inf...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255