Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 42

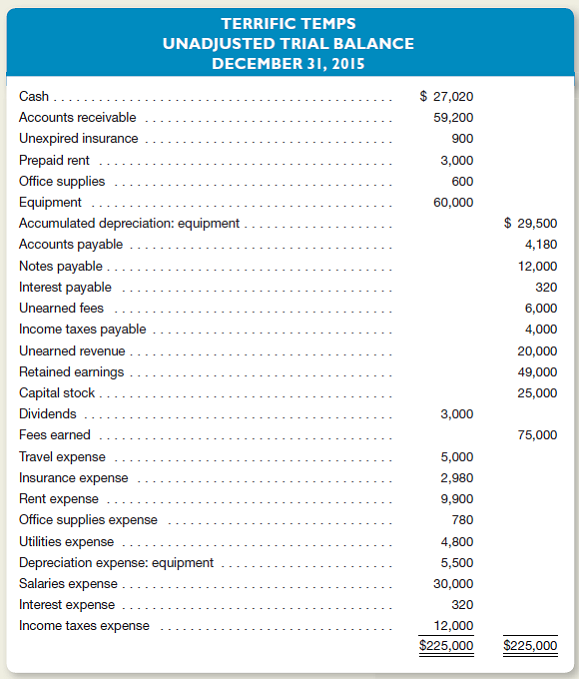

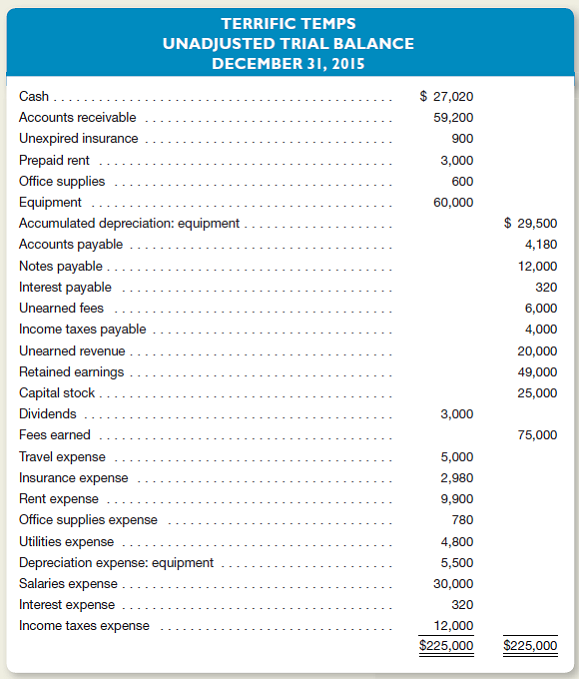

Terrific Temps fills temporary employment positions for local businesses.ome businesses pay in advance for services; others are billed after services have been performed.dvanced payments are credited to an account entitled Unearned Fees.djusting entries are performed on a monthly basis.n unadjusted trial balance dated December 31, 2015, follows.Bear in mind that adjusting entries have already been made for the first 11 months of 2015, but not for December.)

Other Data

1.ccrued but unrecorded fees earned as of December 31, 2015, amount to $1,500.

2.ecords show that $2,500 of cash receipts originally recorded as unearned fees had been earned as of December 31.

3.he company purchased a six-month insurance policy on September 1, 2015, for $1,800.

4.n December 1, 2015, the company paid its rent through February 28, 2016.

5.ffice supplies on hand at December 31 amount to $400.

6.ll equipment was purchased when the business first formed.he estimated life of the equipment at that time was 10 years (or 120 months).

7.n August 1, 2015, the company borrowed $12,000 by signing a six-month, 8 percent note payable.he entire note, plus six months' accrued interest, is due on February 1, 2016.

8.ccrued but unrecorded salaries at December 31 amount to $2,700.

9.stimated income taxes expense for the entire year totals $15,000.axes are due in the first quarter of 2016.

Instructions

a.or each of the numbered paragraphs, prepare the necessary adjusting entry (including an explanation).

b.etermine that amount at which each of the following accounts will be reported in the company's 2015 income statement:

1.ees Earned

2.ravel Expense

3.nsurance Expense

4.ent Expense

5.ffice Supplies Expense

6.tilities Expense

7.epreciation Expense: Equipment

8.nterest Expense

9.alaries Expense

10.ncome Taxes Expense

c.he unadjusted trial balance reports dividends of $3,000.s of December 31, 2015, have these dividends been paid Explain.

Other Data

1.ccrued but unrecorded fees earned as of December 31, 2015, amount to $1,500.

2.ecords show that $2,500 of cash receipts originally recorded as unearned fees had been earned as of December 31.

3.he company purchased a six-month insurance policy on September 1, 2015, for $1,800.

4.n December 1, 2015, the company paid its rent through February 28, 2016.

5.ffice supplies on hand at December 31 amount to $400.

6.ll equipment was purchased when the business first formed.he estimated life of the equipment at that time was 10 years (or 120 months).

7.n August 1, 2015, the company borrowed $12,000 by signing a six-month, 8 percent note payable.he entire note, plus six months' accrued interest, is due on February 1, 2016.

8.ccrued but unrecorded salaries at December 31 amount to $2,700.

9.stimated income taxes expense for the entire year totals $15,000.axes are due in the first quarter of 2016.

Instructions

a.or each of the numbered paragraphs, prepare the necessary adjusting entry (including an explanation).

b.etermine that amount at which each of the following accounts will be reported in the company's 2015 income statement:

1.ees Earned

2.ravel Expense

3.nsurance Expense

4.ent Expense

5.ffice Supplies Expense

6.tilities Expense

7.epreciation Expense: Equipment

8.nterest Expense

9.alaries Expense

10.ncome Taxes Expense

c.he unadjusted trial balance reports dividends of $3,000.s of December 31, 2015, have these dividends been paid Explain.

التوضيح

Adjusted Trial Balance

In an accounting...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255