Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 55

A COMPREHENSIVE ACCOUNTING CYCLE PROBLEM

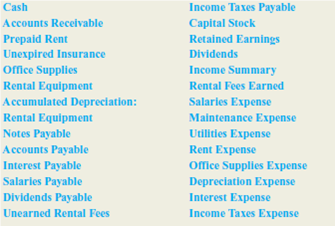

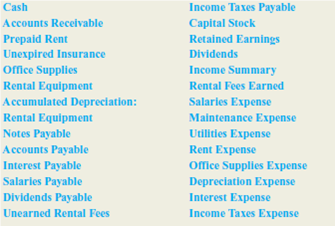

On December 1, 2015, John and Patty Driver formed a corporation called Susquehanna Equipment Rentals.he new corporation was able to begin operations immediately by purchasing the assets and taking over the location of Rent-It, an equipment rental company that was going out of business.he newly formed company uses the following accounts:

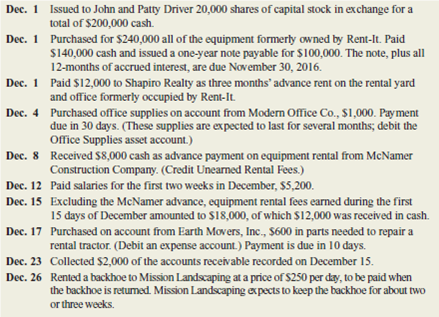

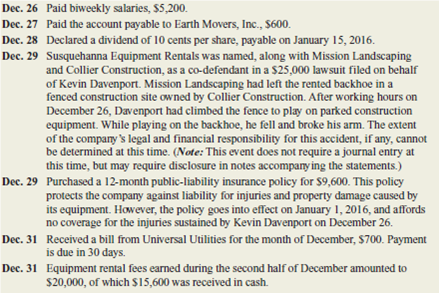

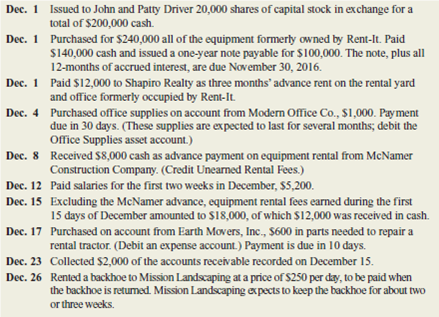

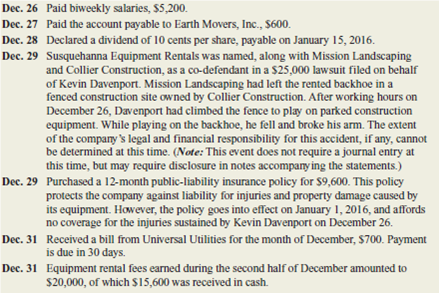

The corporation performs adjusting entries monthly.losing entries are performed annually on December 31.uring December, the corporation entered into the following transactions:

Data for Adjusting Entries

a.he advance payment of rent on December 1 covered a period of three months.

b.he annual interest rate on the note payable to Rent-It is 6 percent.

c.he rental equipment is being depreciated by the straight-line method over a period of eight years.

d.ffice supplies on hand at December 31 are estimated at $600.

e.uring December, the company earned $3,700 of the rental fees paid in advance by McNamer Construction Company on December 8.

f.s of December 31, six days' rent on the backhoe rented to Mission Landscaping on December 26 has been earned.

g.alaries earned by employees since the last payroll date (December 26) amounted to $1,400 at month-end.

h.t is estimated that the company is subject to a combined federal and state income tax rate of 40 percent of income before income taxes (total revenue minus all expenses other than income taxes).hese taxes will be payable in 2016.

Instructions

a.erform the following steps of the accounting cycle for the month of December:

1.ournalize the December transactions.o not record adjusting entries at this point.

2.ost the December transactions to the appropriate ledger accounts.

3.repare the unadjusted trial balance columns of a 10-column worksheet for the year ended December 31.

4.repare the necessary adjusting entries for December.

5.ost the December adjusting entries to the appropriate ledger accounts.

6.omplete the 10-column worksheet for the year ended December 31.

b.repare an income statement and statement of retained earnings for the year ended December 31, and a balance sheet (in report form) as of December 31.

c.repare required disclosures to accompany the December 31 financial statements.our solution should include a separate note addressing each of the following areas: (1) depreciation policy, (2) maturity dates of major liabilities, and (3) potential liability due to pending litigation.

d.repare closing entries and post to ledger accounts.

e.repare an after-closing trial balance as of December 31.

f.uring December, this company's cash balance has fallen from $200,000 to $65,000.oes it appear headed for insolvency in the near future Explain your reasoning.

g.ould it be ethical for Patty Driver to maintain the accounting records for this company, or must they be maintained by someone who is independent of the organization

On December 1, 2015, John and Patty Driver formed a corporation called Susquehanna Equipment Rentals.he new corporation was able to begin operations immediately by purchasing the assets and taking over the location of Rent-It, an equipment rental company that was going out of business.he newly formed company uses the following accounts:

The corporation performs adjusting entries monthly.losing entries are performed annually on December 31.uring December, the corporation entered into the following transactions:

Data for Adjusting Entries

a.he advance payment of rent on December 1 covered a period of three months.

b.he annual interest rate on the note payable to Rent-It is 6 percent.

c.he rental equipment is being depreciated by the straight-line method over a period of eight years.

d.ffice supplies on hand at December 31 are estimated at $600.

e.uring December, the company earned $3,700 of the rental fees paid in advance by McNamer Construction Company on December 8.

f.s of December 31, six days' rent on the backhoe rented to Mission Landscaping on December 26 has been earned.

g.alaries earned by employees since the last payroll date (December 26) amounted to $1,400 at month-end.

h.t is estimated that the company is subject to a combined federal and state income tax rate of 40 percent of income before income taxes (total revenue minus all expenses other than income taxes).hese taxes will be payable in 2016.

Instructions

a.erform the following steps of the accounting cycle for the month of December:

1.ournalize the December transactions.o not record adjusting entries at this point.

2.ost the December transactions to the appropriate ledger accounts.

3.repare the unadjusted trial balance columns of a 10-column worksheet for the year ended December 31.

4.repare the necessary adjusting entries for December.

5.ost the December adjusting entries to the appropriate ledger accounts.

6.omplete the 10-column worksheet for the year ended December 31.

b.repare an income statement and statement of retained earnings for the year ended December 31, and a balance sheet (in report form) as of December 31.

c.repare required disclosures to accompany the December 31 financial statements.our solution should include a separate note addressing each of the following areas: (1) depreciation policy, (2) maturity dates of major liabilities, and (3) potential liability due to pending litigation.

d.repare closing entries and post to ledger accounts.

e.repare an after-closing trial balance as of December 31.

f.uring December, this company's cash balance has fallen from $200,000 to $65,000.oes it appear headed for insolvency in the near future Explain your reasoning.

g.ould it be ethical for Patty Driver to maintain the accounting records for this company, or must they be maintained by someone who is independent of the organization

التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255