Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 69

If Things Get Any Better, We' ll Be Broke

Rock, Inc., sells stereo equipment.raditionally, the company's sales have been in the following categories: cash sales, 25 percent; customers using national credit cards, 35 percent; sales on 'account (due in30days), 40percent.ith these policies, the company earned a modest profit, and monthly cash receipts exceeded monthly cash payments by a comfortable margin.ncollectible accounts expense was approximately I percent of net sales.The company uses the direct write-off method in accounting for uncollectible accounts receivable.)

Two months ago, the company initiated a new credit policy, which it calls "Double Zero." Customers may purchase merchandise on account, with no down payment and no interest charges.

The accounts are collected in 12 monthly instalments of equal amounts.

The plan has proven quite popular with customers, and monthly sales have increased dramatically.espite the increase in sales, however, Rock is experiencing cash flow problems it hasn't been generating enough cash to pay its suppliers, most of which require payment within 30days.

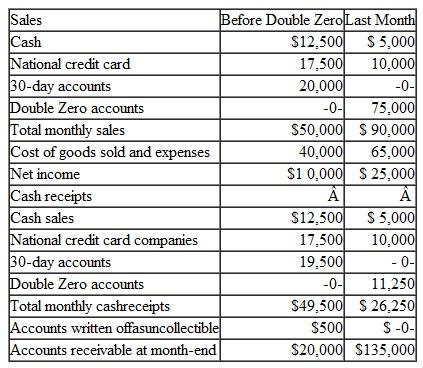

The Company's bookkeeper has prepared the following analysis of monthly operating results:

The bookkeeper offered thefollowing assessment: "Double Zero is killingus.ince we started' that plan, ouraccounts receivable have increased nearly sevenfold, and they're still growing.e , can't afford to carry such a large nonproductive asset onourbooks.urcash receipts are down to nearly half of what they used to be.f we don't go backtomore cash sales andreceivables thatcan becollected more quickly, we'll become insolvent.

In replyMaxwell "Rock" Swartz, founder and chief executiveofficer, shouted out: "Why do you say that our accounts receivable are nonproductive They're the most productive asset we have! Since we started Double Zero, our sales have nearly doubled, our profits have more than doubled, and our bad debt expense has dropped to nothing!"

Instructions

a. Is it logical that the Double Zero plan is causing sales and profits to increase while also.ausing a decline in cash receipts Explain.

b. Why has the uncollectible accounts expense dropped to zeroWhatwould youexpect tohappen to the company's uncollectible accounts expense in the future-say, next year Why

c. Do you think that the reduction in monthly cash receipts is permanentor temporaryExplain..n what sensearethe company's accounts receivable a "nonproductive" asset

e. Suggest several ways that Rock may beable togenerate the cash it needs to pay its bills with outterminating the Double Zero plan.

f. Would you recommend that the company continue offering Double Zero financing, or should it return to the useof 3D-day accounts Explain the reasons for your answer,andidentify any unresolved factors that niight cause you tochange this opinion in thefuture.

التوضيح

a. It is logical and predictable that th...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255