Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 6

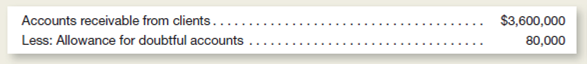

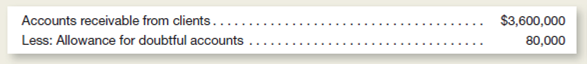

Redstone Mill is a manufacturer that makes all sales on 30-day credit terms.nnual sales are approximately $40 million.t the end of 2014, accounts receivable were presented in the company's balance sheet as follows:

During 2015, $230,000 of specific accounts receivable were written off as uncollectible.f these accounts written off, receivables totaling $18,000 were subsequently collected.t the end of 2015, an aging of accounts receivable indicated a need for a $150,000 allowance to cover possible failure to collect the accounts currently outstanding.

Redstone Mill makes adjusting entries for uncollectible accounts only at year-end.Instructions

a.repare the following general journal entries:

1.ne entry to summarize all accounts written off against the Allowance for Doubtful Accounts during 2015.

2.ntries to record the $18,000 in accounts receivable that were subsequently collected.

3.he adjusting entry required at December 31, 2015, to increase the Allowance for Doubtful Accounts to $150,000.

b.otice that the Allowance for Doubtful Accounts was only $80,000 at the end of 2014, but uncollectible accounts during 2015 totaled $212,000 ($230,000 less the $18,000 reinstated).o these relationships appear reasonable, or was the Allowance for Doubtful Accounts greatly understated at the end of 2014 Explain.

During 2015, $230,000 of specific accounts receivable were written off as uncollectible.f these accounts written off, receivables totaling $18,000 were subsequently collected.t the end of 2015, an aging of accounts receivable indicated a need for a $150,000 allowance to cover possible failure to collect the accounts currently outstanding.

Redstone Mill makes adjusting entries for uncollectible accounts only at year-end.Instructions

a.repare the following general journal entries:

1.ne entry to summarize all accounts written off against the Allowance for Doubtful Accounts during 2015.

2.ntries to record the $18,000 in accounts receivable that were subsequently collected.

3.he adjusting entry required at December 31, 2015, to increase the Allowance for Doubtful Accounts to $150,000.

b.otice that the Allowance for Doubtful Accounts was only $80,000 at the end of 2014, but uncollectible accounts during 2015 totaled $212,000 ($230,000 less the $18,000 reinstated).o these relationships appear reasonable, or was the Allowance for Doubtful Accounts greatly understated at the end of 2014 Explain.

التوضيح

Accounts receivable is the money that co...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255