Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 41

Accounting for Uncollectible Accounts: A Balance Sheet Approach

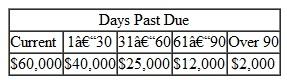

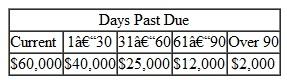

Pachel Corporation reports the following information pertaining to its accounts receivable:

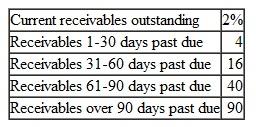

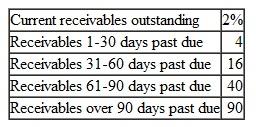

The company's credit department provided the following estimates regarding the percent of accounts expected to eventually be written off from each category listed above:

The company uses a balance sheet approach to estimate credit losses.

a Record the company's uncollectible accounts expense, assuming it has a $1,400 credit balance in its Allowance for Doubtful Accounts prior to making the necessary adjustment.

b Record the company's uncollectible accounts expense, assuming it has a $1,600 debit balance in its Allowance for Doubtful Accounts prior to making the necessary adjustment.

Pachel Corporation reports the following information pertaining to its accounts receivable:

The company's credit department provided the following estimates regarding the percent of accounts expected to eventually be written off from each category listed above:

The company uses a balance sheet approach to estimate credit losses.

a Record the company's uncollectible accounts expense, assuming it has a $1,400 credit balance in its Allowance for Doubtful Accounts prior to making the necessary adjustment.

b Record the company's uncollectible accounts expense, assuming it has a $1,600 debit balance in its Allowance for Doubtful Accounts prior to making the necessary adjustment.

التوضيح

a.Prepare entry to record the uncollecti...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255