Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 61

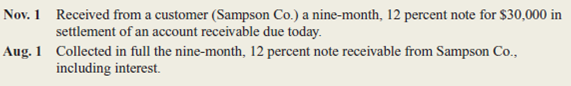

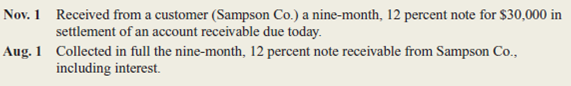

Midtown Distribution sells a variety of merchandise to retail stores on account, but it insists that any customer who fails to pay an invoice when due must replace their account receivable with an interest-bearing note.he company adjusts and closes its accounts at December 31.mong the transactions relating to notes receivable were the following:

Instructions

a.repare journal entries (in general journal form) to record: (1) the receipt of the note on November 1; (2) the adjustment for interest on December 31; and (3) the collection of principal and interest on August 1.To better illustrate the allocation of interest revenue between accounting periods, we will assume Midtown makes adjusting entries only at year-end.

b.ssume that instead of paying the note on August 1, the customer (Sampson Co.) had defaulted.ive the journal entry by Midtown to record the default.ssume that Sampson Co.as sufficient resources that the note eventually will be collected.

c.xplain why the company insists that any customer who fails to pay an invoice when due must replace it with an interest-bearing note.

Instructions

a.repare journal entries (in general journal form) to record: (1) the receipt of the note on November 1; (2) the adjustment for interest on December 31; and (3) the collection of principal and interest on August 1.To better illustrate the allocation of interest revenue between accounting periods, we will assume Midtown makes adjusting entries only at year-end.

b.ssume that instead of paying the note on August 1, the customer (Sampson Co.) had defaulted.ive the journal entry by Midtown to record the default.ssume that Sampson Co.as sufficient resources that the note eventually will be collected.

c.xplain why the company insists that any customer who fails to pay an invoice when due must replace it with an interest-bearing note.

التوضيح

Accounts receivable is the money that co...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255