Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 15

Data Management, Inc., provided the following information at December 31, 2015:

Marketable Securities

The company invested $75,000 in a portfolio of marketable securities on December 9, 2015.he portfolio's market value on December 31, 2015, had decreased in value to $68,000.

Notes Receivable

On October 1, 2015, Data Management sold 50 laptop computers to the Mifflinburg School District for $74,500.he school district paid $2,500 at the point of sale and issued a one-year, $72,000, 6 percent note for the remaining balance.he note, plus accrued interest, is due in full on September 30, 2016.ata Management adjusts for accrued interest revenue monthly.

Accounts Receivable

Data Management uses a balance sheet approach to account for uncollectible accounts expense.utstanding accounts receivable on December 31, 2015, total $900,000.fter aging these accounts, the company estimates that their net realizable value is $860,000.rior to making any adjustment to record uncollectible accounts expense, Data Management's Allowance for Doubtful Accounts has a debit balance of $9,000.

Instructions

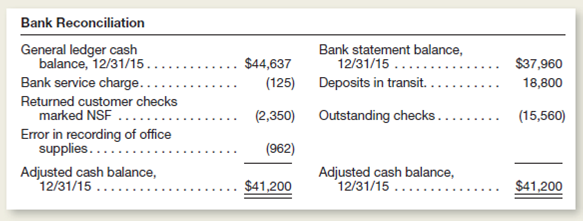

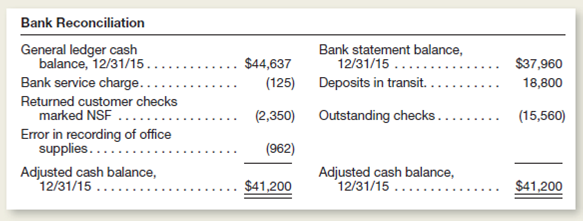

a.repare the journal entry necessary to update the company's accounts immediately after performing its bank reconciliation on December 31, 2015.

b.repare the journal entry necessary to adjust the company's marketable securities to market value at December 31, 2015.

c.repare the journal entry necessary to accrue interest revenue in December 2015.

d.repare the journal entry necessary to report the company's accounts receivable at their net realizable value at December 31, 2015.

e.iscuss briefly why the company's Allowance for Doubtful Accounts had a debit balance prior to the adjustment made in part d.ow might the company change the percentages it applies to the accounts receivable aging categories to avoid future debit balances in its Allowance for Doubtful Accounts

Marketable Securities

The company invested $75,000 in a portfolio of marketable securities on December 9, 2015.he portfolio's market value on December 31, 2015, had decreased in value to $68,000.

Notes Receivable

On October 1, 2015, Data Management sold 50 laptop computers to the Mifflinburg School District for $74,500.he school district paid $2,500 at the point of sale and issued a one-year, $72,000, 6 percent note for the remaining balance.he note, plus accrued interest, is due in full on September 30, 2016.ata Management adjusts for accrued interest revenue monthly.

Accounts Receivable

Data Management uses a balance sheet approach to account for uncollectible accounts expense.utstanding accounts receivable on December 31, 2015, total $900,000.fter aging these accounts, the company estimates that their net realizable value is $860,000.rior to making any adjustment to record uncollectible accounts expense, Data Management's Allowance for Doubtful Accounts has a debit balance of $9,000.

Instructions

a.repare the journal entry necessary to update the company's accounts immediately after performing its bank reconciliation on December 31, 2015.

b.repare the journal entry necessary to adjust the company's marketable securities to market value at December 31, 2015.

c.repare the journal entry necessary to accrue interest revenue in December 2015.

d.repare the journal entry necessary to report the company's accounts receivable at their net realizable value at December 31, 2015.

e.iscuss briefly why the company's Allowance for Doubtful Accounts had a debit balance prior to the adjustment made in part d.ow might the company change the percentages it applies to the accounts receivable aging categories to avoid future debit balances in its Allowance for Doubtful Accounts

التوضيح

Bank reconciliation is performed to reco...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255