Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 58

On August 1, 2015, Hampton Construction received a 9 percent, six-month note receivable from Dusty Roads, one of Hampton Construction's problem credit customers.oads had owed $36,000 on an outstanding account receivable.he note receivable was taken in settlement of this amount.ssume that Hampton Construction makes adjusting entries for accrued interest revenue once each year on December 31.

a.ournalize the following four events on the books of Hampton Construction.

1.ecord the receipt of the note on August 1 in settlement of the account receivable.

2.ecord accrued interest at December 31, 2015.

3.ssume that Dusty Roads pays the note plus accrued interest in full.ecord the collection of the principal and interest on January 31, 2016.

4.ssume that Dusty Roads did not make the necessary principal and interest payment on January 31, 2016.ather, assume that he defaulted on his obligation.ecord the default on January 31, 2016.

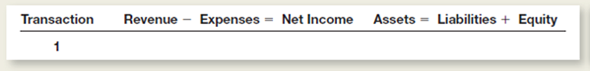

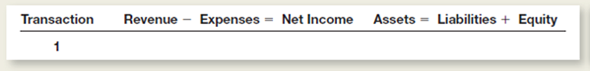

b.ndicate the effects of each of the four transactions journalized in part a on the elements of the financial statement shown below.se the code letters I for increase, D for decrease, and NE for

no effect.

a.ournalize the following four events on the books of Hampton Construction.

1.ecord the receipt of the note on August 1 in settlement of the account receivable.

2.ecord accrued interest at December 31, 2015.

3.ssume that Dusty Roads pays the note plus accrued interest in full.ecord the collection of the principal and interest on January 31, 2016.

4.ssume that Dusty Roads did not make the necessary principal and interest payment on January 31, 2016.ather, assume that he defaulted on his obligation.ecord the default on January 31, 2016.

b.ndicate the effects of each of the four transactions journalized in part a on the elements of the financial statement shown below.se the code letters I for increase, D for decrease, and NE for

no effect.

التوضيح

Account receivable: It refers to money o...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255