Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 23

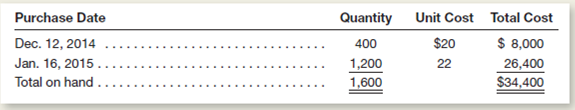

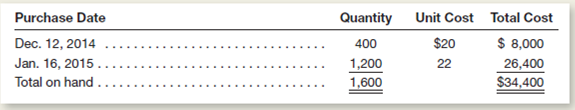

On January 22, 2015, Dobbins Supply, Inc., sold 700 toner cartridges to Foster Office Fitters.mmediately prior to this sale, Dobbins Supply's perpetual inventory records for these units included the following cost layers:

Instructions

Note: We present this problem in the normal sequence of the accounting cycle-that is, journal entries before ledger entries.owever, you may find it helpful to work part b first.

a.repare a separate journal entry to record the cost of goods sold relating to the January 22 sale of 700 toner cartridges, assuming that Dobbins supply uses:

1.pecific identification (300 of the units sold had been purchased on December 12, and the remaining 400 had been purchased on January 16).

2.verage cost.

3.IFO.

4.IFO.

b.omplete a subsidiary ledger record for the toner cartridges using each of the four inventory valuation methods listed above.our inventory records should show both purchases of this product, the sale on January 22, and the balance on hand at December 12, January 16, and January 22.se the formats for inventory subsidiary records illustrated on pages 345-347 of this chapter.

c.efer to the cost of goods sold figures computed in part a.or financial reporting purposes, can Dobbins Supply, Inc.se the valuation method that resulted in the highest cost of goods sold if, for tax purposes, it used the method that resulted in the lowest cost of goods sold Explain.

Problems 8.2B and 8.3B are based on the following data:

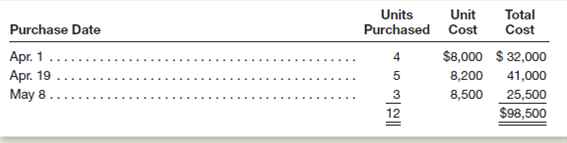

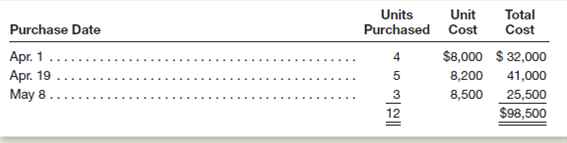

Sea Travel sells motor boats.ne of Sea Travel's most popular models is the Wing.uring the current year, Sea Travel purchased 12 Wings at the following costs:

Instructions

Note: We present this problem in the normal sequence of the accounting cycle-that is, journal entries before ledger entries.owever, you may find it helpful to work part b first.

a.repare a separate journal entry to record the cost of goods sold relating to the January 22 sale of 700 toner cartridges, assuming that Dobbins supply uses:

1.pecific identification (300 of the units sold had been purchased on December 12, and the remaining 400 had been purchased on January 16).

2.verage cost.

3.IFO.

4.IFO.

b.omplete a subsidiary ledger record for the toner cartridges using each of the four inventory valuation methods listed above.our inventory records should show both purchases of this product, the sale on January 22, and the balance on hand at December 12, January 16, and January 22.se the formats for inventory subsidiary records illustrated on pages 345-347 of this chapter.

c.efer to the cost of goods sold figures computed in part a.or financial reporting purposes, can Dobbins Supply, Inc.se the valuation method that resulted in the highest cost of goods sold if, for tax purposes, it used the method that resulted in the lowest cost of goods sold Explain.

Problems 8.2B and 8.3B are based on the following data:

Sea Travel sells motor boats.ne of Sea Travel's most popular models is the Wing.uring the current year, Sea Travel purchased 12 Wings at the following costs:

التوضيح

Accounts receivable is the money that co...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255