Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 51

Alternative Cost FlowAssumptions in aPerpetual System

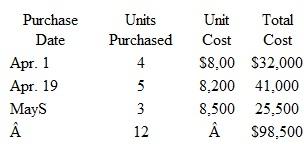

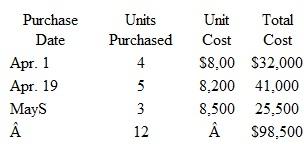

Sea Travel sells motor boats.ne of Sea Travel's most popular models is the Wing.uring the current year, Sea Travel purchased 12 of these boats at the following costs:

On April 28, Sea Travel sold five Wings to the Jack Sport racing team.he remaining seven boats remained in inventory at June 30, the end ofSea Travel's fiscal year.

Assume that Sea Travel uses a perpetual inventory system.See the data given above.)

Instructions

a.ompute (a) the cost of goods sold relating to the sale on April 28 and (b) the ending inventory of Wing boats at June 30, using the following cost flow assumptions:

1.verage cost (round cost to nearest whole dollar).

2.IFO.

3.IFO.

Show the number of units and the unit costs of each layer comprising the cost of goods sold and ending inventory.

b.sing the cost figures computed in part a, answer the following questions:

1.hich of the three cost flow assumptions will result in Sea Travel reporting the lowest net income for the current year Would this always be the case Explain.

2.hich of the three cost flow assumptions will result in the highest income tax expense for the year Would you expect this usually to be the case Explain.

3.ay Sea Travel use the cost flow assumption that results in the lowest net income for the current year in its financial statements, but use the cost flow assumption that maximi zes taxable income for the current year in its income tax return Explain.

Sea Travel sells motor boats.ne of Sea Travel's most popular models is the Wing.uring the current year, Sea Travel purchased 12 of these boats at the following costs:

On April 28, Sea Travel sold five Wings to the Jack Sport racing team.he remaining seven boats remained in inventory at June 30, the end ofSea Travel's fiscal year.

Assume that Sea Travel uses a perpetual inventory system.See the data given above.)

Instructions

a.ompute (a) the cost of goods sold relating to the sale on April 28 and (b) the ending inventory of Wing boats at June 30, using the following cost flow assumptions:

1.verage cost (round cost to nearest whole dollar).

2.IFO.

3.IFO.

Show the number of units and the unit costs of each layer comprising the cost of goods sold and ending inventory.

b.sing the cost figures computed in part a, answer the following questions:

1.hich of the three cost flow assumptions will result in Sea Travel reporting the lowest net income for the current year Would this always be the case Explain.

2.hich of the three cost flow assumptions will result in the highest income tax expense for the year Would you expect this usually to be the case Explain.

3.ay Sea Travel use the cost flow assumption that results in the lowest net income for the current year in its financial statements, but use the cost flow assumption that maximi zes taxable income for the current year in its income tax return Explain.

التوضيح

(a) Computing Cost of goods sold and per...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255