Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 4

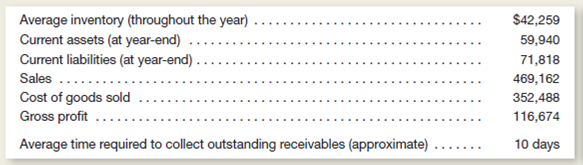

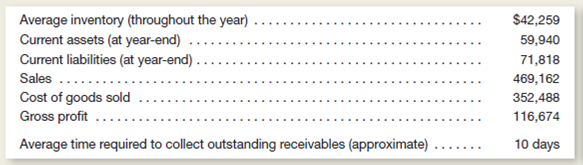

Walmart uses LIFO to account for its inventories.ecent financial statements were used to compile the following information (dollar figures are in millions):

Instructions

a.sing the information provided, compute the following measures based upon the LIFO method:

1.nventory turnover.

2.urrent ratio (see Chapter 5 for a discussion of this ratio).

3.ross profit rate (see Chapter 6 for a discussion of this statistic).

b.ssuming cost of goods sold would be lower under FIFO, what circumstances must the company have encountered to cause this situation (Were replacement costs, on average, rising or falling)

c.ow would you expect these ratios to differ (i.e., what direction) had the company used FIFO instead of LIFO

d.xplain why the average number of days required by Walmart to collect its accounts receivable is so low.See Chapter 7 for a discussion of the accounts receivable turnover rate.)

Instructions

a.sing the information provided, compute the following measures based upon the LIFO method:

1.nventory turnover.

2.urrent ratio (see Chapter 5 for a discussion of this ratio).

3.ross profit rate (see Chapter 6 for a discussion of this statistic).

b.ssuming cost of goods sold would be lower under FIFO, what circumstances must the company have encountered to cause this situation (Were replacement costs, on average, rising or falling)

c.ow would you expect these ratios to differ (i.e., what direction) had the company used FIFO instead of LIFO

d.xplain why the average number of days required by Walmart to collect its accounts receivable is so low.See Chapter 7 for a discussion of the accounts receivable turnover rate.)

التوضيح

FIFO:

FIFO refers to First-in-First-Out...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255