Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 22

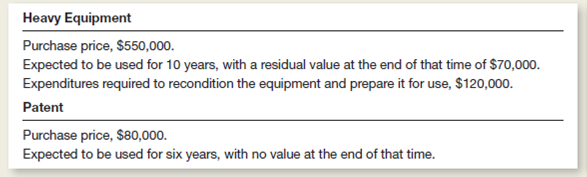

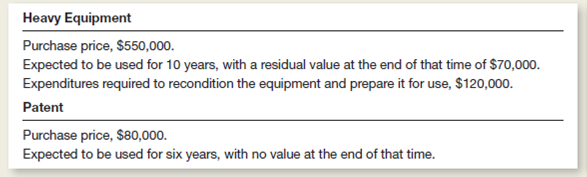

During the current year, Rodgers Company purchased two assets that are described as follows:

Rodgers depreciates heavy equipment by the declining-balance method at 200 percent of the straight-line rate.t amortizes intangible assets by the straight-line method.t the end of two years, because of changes in Rodgers's core business, it sold the patent to a competitor for $38,000.

Instructions

a.ompute the amount of depreciation expense on the heavy equipment for each of the first three years of the asset's life.

b.ompute the amount of amortization on the patent for each of the two years it was owned by Rodgers.

c.repare the plant and intangible assets section of Rodgers's balance sheet at the end of the first and second years.lso, calculate the amount of the gain or loss on the patent that would be included in the second year's income statement.

Rodgers depreciates heavy equipment by the declining-balance method at 200 percent of the straight-line rate.t amortizes intangible assets by the straight-line method.t the end of two years, because of changes in Rodgers's core business, it sold the patent to a competitor for $38,000.

Instructions

a.ompute the amount of depreciation expense on the heavy equipment for each of the first three years of the asset's life.

b.ompute the amount of amortization on the patent for each of the two years it was owned by Rodgers.

c.repare the plant and intangible assets section of Rodgers's balance sheet at the end of the first and second years.lso, calculate the amount of the gain or loss on the patent that would be included in the second year's income statement.

التوضيح

Depreciation is an accounting term used ...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255