Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 46

Fifteen transactions or events affecting Philmar, Inc., are as follows:

a.ade a year-end adjusting entry to accrue interest on a note payable that has the interest rate stated separately from the principal amount.

b. liability classified for several years as long-term becomes due within the next 12 months.

c.ecorded the regular weekly payroll, including payroll taxes, amounts withheld from employees, and the issuance of paychecks.

d.arned an amount previously recorded as unearned revenue.

e.ade arrangements to extend a bank loan due in 60 days for another 36 months.

f.ade a monthly payment on a fully amortizing installment note payable.Assume this note is classified as a current liability.)

g.alled bonds payable due in 10 years at a price below the carrying value of the liability in the accounting records.

h.ssued bonds payable at 101 on January 31, 2015.he bonds pay interest on January 31 and July 31.

i.ecorded July 31, 2015, interest expense and made semiannual interest payment on bonds referred to in part h.j.ecorded necessary adjusting entry on December 31, 2015, for bonds referred to in part h.k.ssued bonds payable at 98 on August 31, 2015.he bonds pay interest August 31 and February 28.

l.ecorded the necessary adjusting entry on December 31, 2015, for bonds referred to in part k.m.ecorded an estimated liability for warranty claims.

n.ntered into a five-year commitment to buy all supplies from a particular supplier at a price 20 percent below market.

o.eceived notice that a lawsuit has been filed against the company for $8 million.he amount of the company's liability, if any, cannot be reasonably estimated at this time.

Instructions

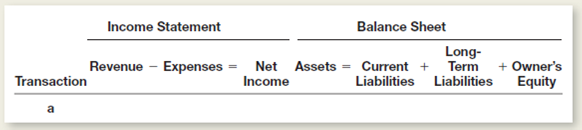

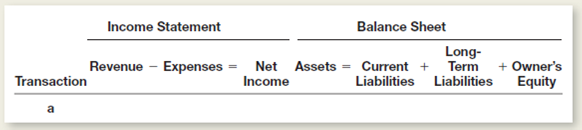

Indicate the effects of each of these transactions upon the following elements of the company's financial statements.rganize your answer in tabular form, using the column headings shown below.se the following code letters to indicate the effects of each transaction on the accounting elements listed in the column headings: I for increase, D for decrease, and NE for no effect.

a.ade a year-end adjusting entry to accrue interest on a note payable that has the interest rate stated separately from the principal amount.

b. liability classified for several years as long-term becomes due within the next 12 months.

c.ecorded the regular weekly payroll, including payroll taxes, amounts withheld from employees, and the issuance of paychecks.

d.arned an amount previously recorded as unearned revenue.

e.ade arrangements to extend a bank loan due in 60 days for another 36 months.

f.ade a monthly payment on a fully amortizing installment note payable.Assume this note is classified as a current liability.)

g.alled bonds payable due in 10 years at a price below the carrying value of the liability in the accounting records.

h.ssued bonds payable at 101 on January 31, 2015.he bonds pay interest on January 31 and July 31.

i.ecorded July 31, 2015, interest expense and made semiannual interest payment on bonds referred to in part h.j.ecorded necessary adjusting entry on December 31, 2015, for bonds referred to in part h.k.ssued bonds payable at 98 on August 31, 2015.he bonds pay interest August 31 and February 28.

l.ecorded the necessary adjusting entry on December 31, 2015, for bonds referred to in part k.m.ecorded an estimated liability for warranty claims.

n.ntered into a five-year commitment to buy all supplies from a particular supplier at a price 20 percent below market.

o.eceived notice that a lawsuit has been filed against the company for $8 million.he amount of the company's liability, if any, cannot be reasonably estimated at this time.

Instructions

Indicate the effects of each of these transactions upon the following elements of the company's financial statements.rganize your answer in tabular form, using the column headings shown below.se the following code letters to indicate the effects of each transaction on the accounting elements listed in the column headings: I for increase, D for decrease, and NE for no effect.

التوضيح

Liabilities:

Liabilities are the claims...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255